Can the FOMC Truly Pivot? A Glimpse into Forward-Looking Indicators

The prevailing market sentiment suggests an anticipated FOMC pivot towards a rate reduction. However, one must ponder the implications should inflation rear its head once again, necessitating the FOMC to maintain higher rates or even consider rate hikes.

Source: CME Group - FedWatch Tool

Balancing market expectations with reality has always been a delicate dance. The interplay between these two often determines risks and opportunities. The FOMC's decisions around rate adjustments—be it holding, increasing, or decreasing—have been a hotbed of discussion over the past couple of years, and rightfully so. Their stance on monetary policy, whether easy or restrictive, carries significant market repercussions.

Come Wednesday, September 20, 2023, the Fed is set to unveil another rate decision. As stewards of our clients' investments at SYKON Capital, we believe it's paramount to discern the market's rate expectations to optimally position our portfolios.

Current data from the CME FOMC rate probabilities tables reveals a nearly unanimous market sentiment; there's a 99% likelihood that the FOMC will maintain the status quo come Wednesday. The prevailing consensus hints at stable rates through May 2024, followed by a 0.25% reduction every alternate meeting till the year's end.

However, what if the Fed diverges from this anticipated trajectory? The true risk materializes if the Fed chooses not to cut rates, potentially ushering in heightened market volatility. Jerome Powell, in his tenure, has consistently communicated a robust stance against inflation. He remains unwavering in his commitment to not prematurely ease monetary policy, a lesson hard-earned from the inflationary challenges of the 1970s.

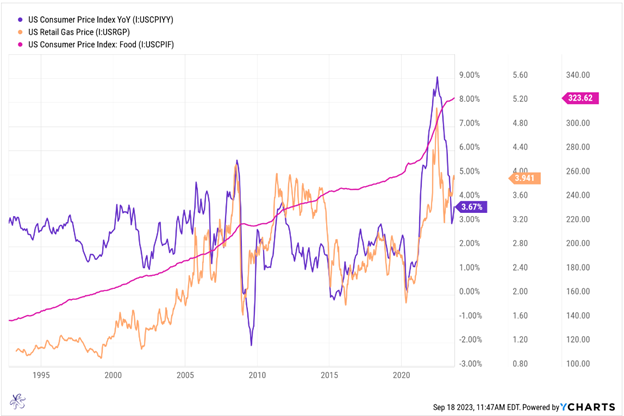

Interestingly, markets have entered a phase where unfavorable news is perceived positively, since it ostensibly augments the likelihood of the Fed slashing rates. But one wonders, is a rate cut genuinely feasible at this juncture? While a comprehensive analysis is warranted, some evident correlations stand out. For instance, the interrelation between fluctuations in US Retail Gas prices and the year-over-year CPI is noteworthy. A significant driver behind the recent oscillations in CPI was gas prices. It's evident when, despite escalating food costs, the overall CPI tapered off as gas prices plummeted. However, the recent uptick in gas prices has correlated with a CPI increase in the past couple of months.

In our forthcoming monthly market call this Wednesday, we'll delve deeper into these dynamics. For now, it's essential to recognize that market optimism regarding an imminent rate cut by the Fed might be premature. Before the FOMC can even contemplate a rate cut, it's crucial that primary inflationary factors diminish substantially.

It's pivotal to note that if the market pins hopes on a rate cut and the Fed either holds or hikes rates, we might witness increased market volatility. As always, staying informed and agile is the key.

As we navigate the intricate dance between market expectations and the realities of economic indicators, it's crucial to approach the future with both caution and insight. The FOMC's decisions have far-reaching consequences on the market landscape. While prevailing sentiment leans towards rate cuts, the very foundation of these assumptions—be it inflationary indicators like gas prices or broader economic factors—must be continually re-evaluated. At SYKON Capital, we understand that trying to predict the market's future is a blend of science and art. It's essential to remain vigilant, informed, and adaptable, ensuring that our investment strategies not only respond to present conditions but also anticipate future shifts. In this ever-evolving financial environment, foresight, preparation, and adaptability will be essential.