Changing inflation expectations

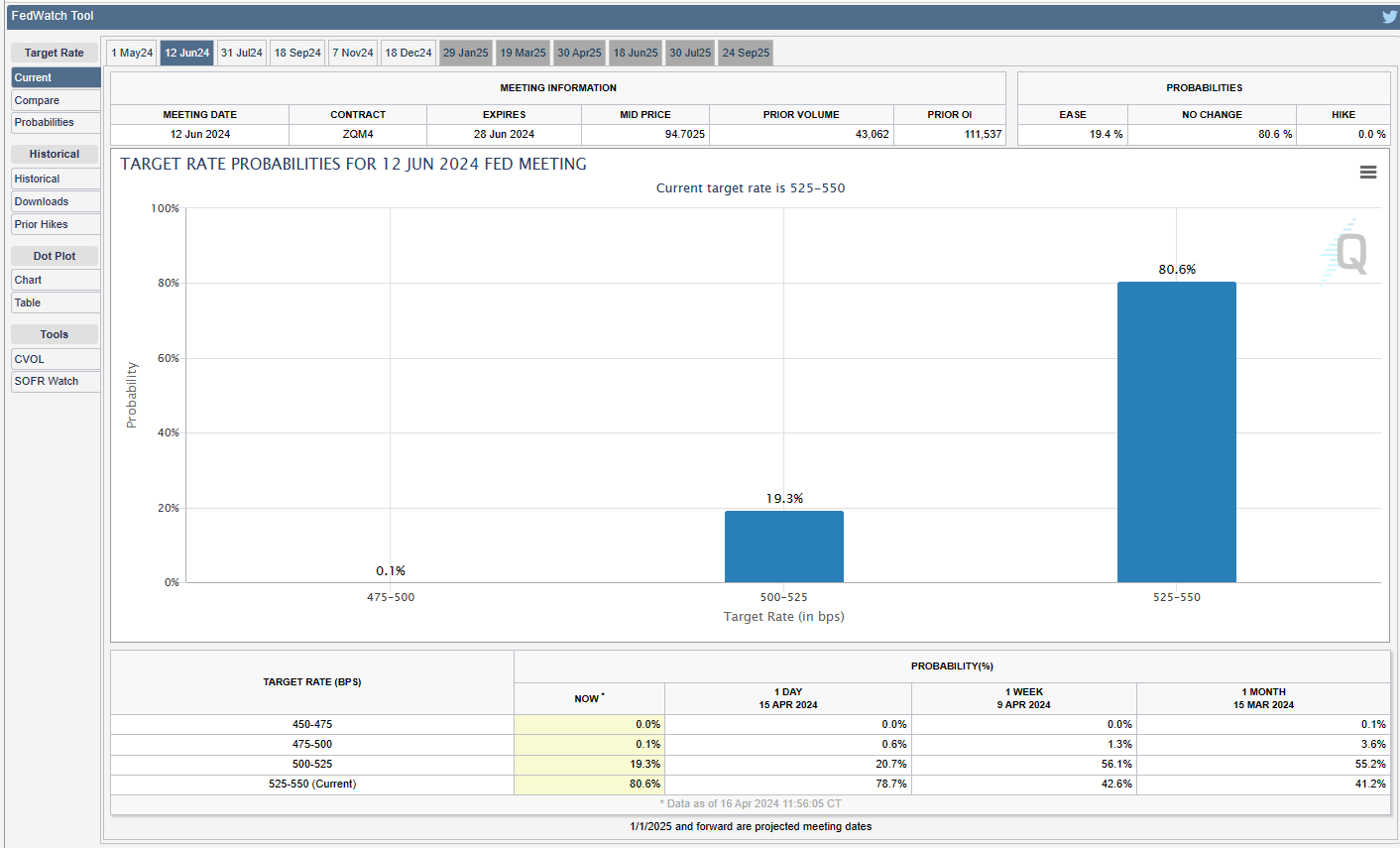

Fed Rate Cut Expectations Ease

Source: CME Fed Watch Tool

The recent spike in market volatility may be related to the reality that the market is rapidly adjusting the expectations that the FOMC will be cutting Fed Funds rate. Earlier in the year it was expected that the FOMC would cut rates 6 times this year. This has now decreased to the expectation of just 2 to 3 rate cuts now. The CME Fed Watch Tool displays how the rate cut expectation for June have declined from 55.2% one month ago, to just 19.3% today. Continued shifts in rate cutting expectation can lead to continued uncertainty and volatility in the equity and fixed income markets.

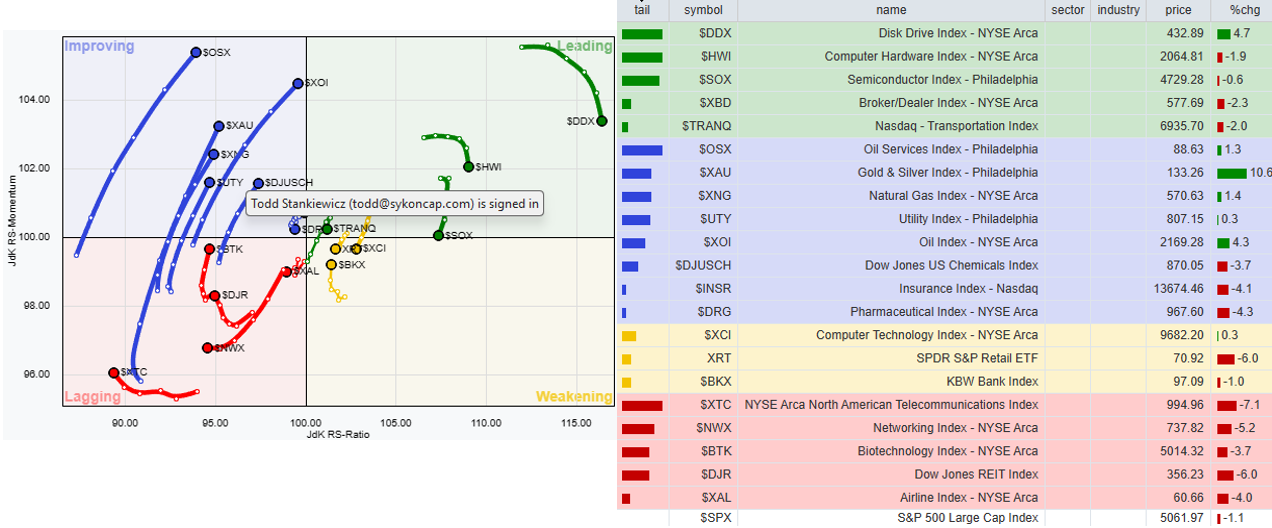

Commodities are leading the way

Source: Stockcharts.com

Relative Rotation Graphs (RRG) are a useful tool for seeing how multiple markets are trading relative to a central index, such as the S&P500 in this case. The top left quadrant represents improving sectors relative to the S&P500 index. Many of the improving indices on a relative basis are commodity-based indices. All the while, the equity growth leaders are rolling over. This may suggest that there is more inflation on the way and the expectation for future rate cuts could potentially decline further.

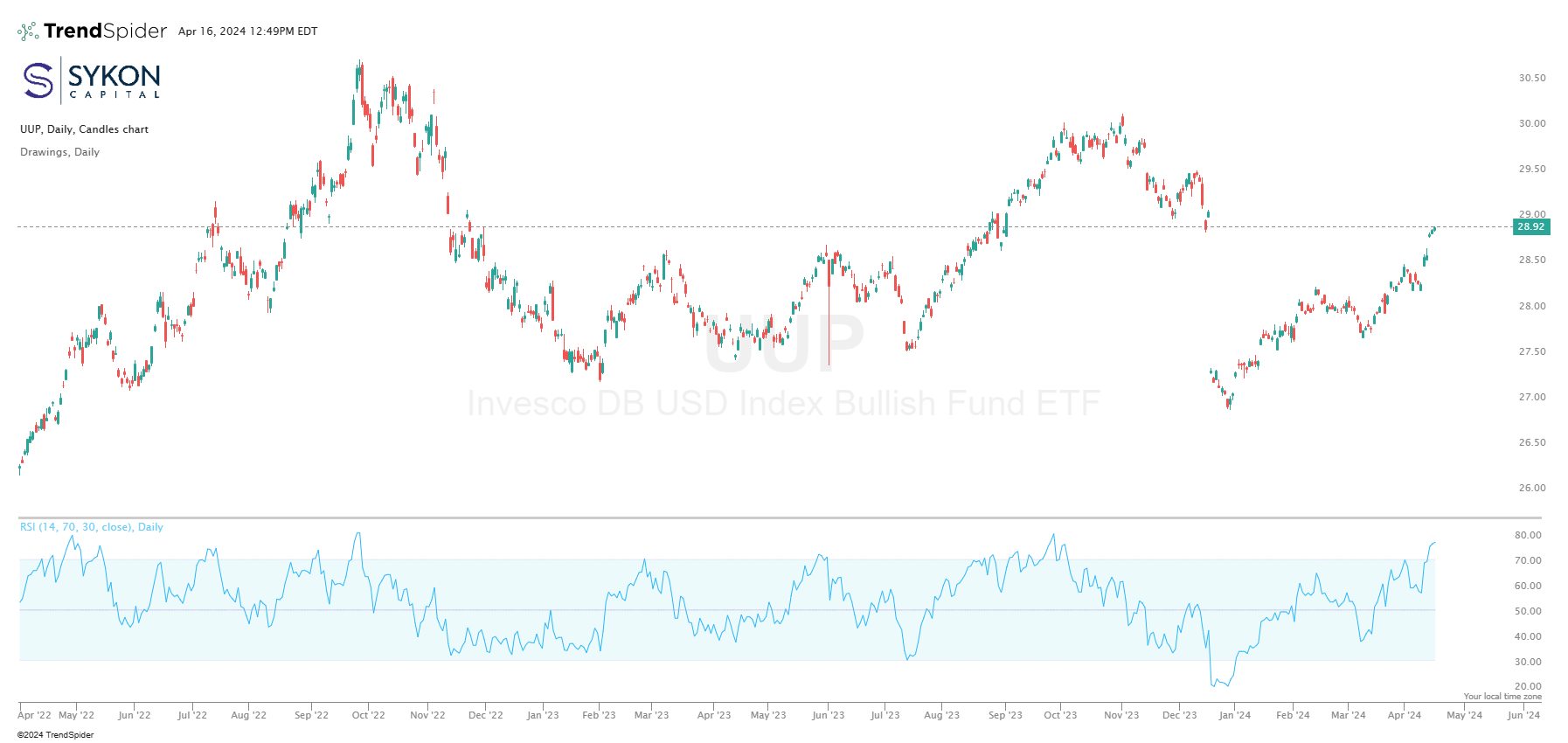

U.S. Dollar may be exhausted

After a very strong rally, the US dollar Bullish ETF (UUP), a proxy for the US dollar index, may be exhausted. It has recently hit an RSI of 77.81. This is technically overbought. When the ETF has hit previous RSI readings in this range, it has indicated a meaningful topping formation. Assets that benefit from a declining dollar, such as international equities and bonds, may offer opportunity if the US dollar does reverse course.