Do NOT fall victim to the “US Equities are the be all” narrative!

The media loves to sell you on the superiority of the US equity markets, but the narrative is starting to shift as international and emerging markets begin to take the lead.

What if the S&P 500 isn’t the answer anymore?

For over a decade, many people perceived investing as simple. VOO and chill. Just buy the S&P 500 and move on. It’s become the go-to strategy for passive investors, advisors, and just about every TikTok investing “expert.”

But here's the thing: when a strategy becomes gospel, people stop thinking critically.

And right now, there are signs that things are changing.

We're seeing shifts under the surface. Global markets are gaining strength. Relative momentum is breaking away from U.S. equities. The question isn't whether the S&P 500 has been great. It's whether it's still the best answer going forward.

The Problem with Home Bias

Sticking to U.S. stocks is less about long-term strategy and more about chasing past performance. It causes investors to ignore a massive part of the investable universe. One of the most diverse global indices, the MSCI All Country World Index, allocates nearly 50 percent of its weight outside the U.S.

Ignoring international markets could mean ignoring half the opportunity set.

A Shift in Relative Performance Is Underway

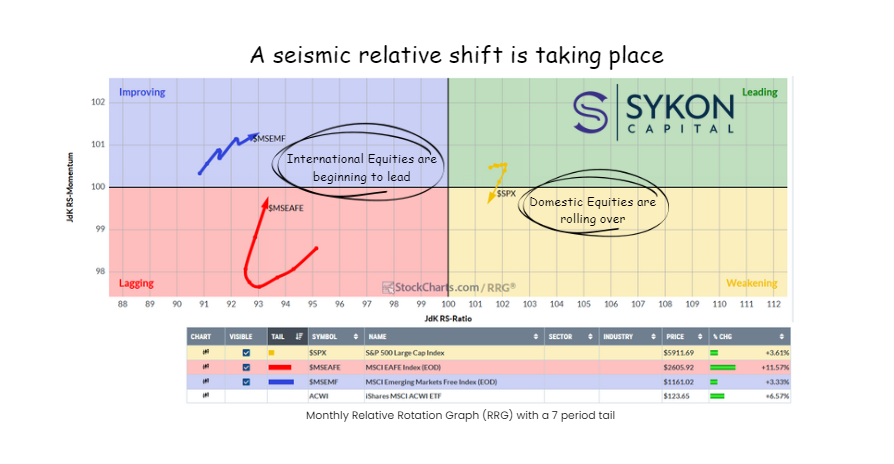

There’s a quiet rotation happening, and tools like Relative Rotation Graphs (RRGs) make it obvious.

If you use the iShares All Country World index ETF (ACWI) as the focal point, you can see how different indices are performing relative to it:

• Moving clockwise from the lower left to the upper right quadrant signals improving relative strength

• Moving clockwise from the upper right to the lower left indicates weakening relative momentum

Emerging markets (MSEMG) and developed international markets (MSEAFE) are both gaining on the S&P 500. If you’re only focused on domestic names, you’re probably missing a real shift in leadership.

You Need a Strategy That Can Shift with the Market

Let’s be honest. International has been a drag. It’s underperformed badly for the better part of the past decade. That’s exactly why having a flexible strategy matters.

At SYKON, this is how we manage portfolios. We follow market signals and adjust accordingly. When international strength builds, we tilt toward it. When domestic trends reassert, we’re ready to lean back in.

Tactical allocation is about staying responsive and recognizing where things are heading, not where they’ve been.

Domestic Isn’t Dead. But It Needs a Catalyst

This isn't about ditching the U.S. market. That would be lazy thinking. No smart allocation is ever all in or all out. But it does mean domestic exposure has to be more intentional.

Relying on passive index exposure to carry the next cycle might be a mistake. The next leg of the domestic market will need a real driver.

That driver could be:

• A shift toward lower volatility, high-quality value stocks

• Policy-driven change, where certain companies benefit from value unlocked through deregulation

Deregulation can serve as a powerful catalyst, especially in sectors that have been constrained by outdated policies or burdensome compliance frameworks. Companies with the financial flexibility and exposure to these areas may be positioned to outperform as those constraints are lifted.

This is a theme we’ll explore in more detail in an upcoming post.

The Next Decade Will Look Different

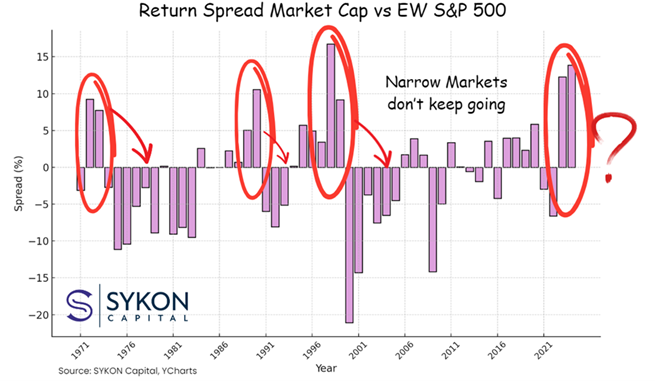

What worked over the last ten years probably won’t drive the next ten. Concentration in a handful of U.S. mega-caps has carried this market cycle. But history has a way of balancing things out.

After long stretches of narrow leadership, markets tend to broaden out. Global exposure starts to matter again. And if there’s ever been a period ripe for that kind of rotation, it’s this one.

There’s a chart I shared back in January that captured this idea. It showed how performance concentration eventually gives way to diversification. This cycle has been one of the most extreme examples in the past 50 years.

Final Thoughts: Are You Allocated for What’s Next?

If your portfolio still looks like it did five years ago, it’s time for a reset.

Markets evolve. Strategies should too.

At SYKON, we help clients build portfolios that adjust with the landscape. Whether it’s U.S., international, or somewhere in between, it’s about being ready, not reactive.

Ready to rethink your allocation?

Schedule a complimentary strategy call today.