Fixed Income ETFs: The New Frontier of Fixed income Investing

At SYKON Capital we focus almost exclusively on using passive, index-based ETFs to allocate clients’ assets. It was not always this way. About 10 years ago we sensed that the industry dynamic was changing, and the data spoke for itself. Over the long term most active fund managers underperform the benchmark and the ones that do are usually doing it because of significant benchmark deviation [Actively Managed Funds Continue to Underperform | Morningstar]. This suggested that alpha based solely on security selection was becoming harder and harder.

Our adoption of ETFs obviously encompassed the obvious factors:

1. The average ETF expense ratio is lower than the average Mutual Fund expense ratio

2. Potentially Lower Execution Costs

3. More tax efficiency.

4. Intraday tradability.

5. Previous business day price transparency

While these characteristics are often spoken about, I do not believe the market truly appreciates how important they can be.

I believe this to be especially true in fixed income. The SYKON Portfolio management team was one of the early adopters of fixed income ETFs in 2013, when this space was in its infancy. We realized the additional advantages that the liquidity profile ETFs provided to fixed income portfolio management over using individual securities or mutual funds. This has allowed our team to be pioneers in creating factors-based fixed income indices that would have been previously impossible to execute. Topics of which I was fortunate to be invited and provide a key note presentation at the Inside ETFs – Fixed Income conference back in November of 2016 titled, “Adapt or Die: The Evolution of Fixed Income”.

This concept is particularly important because most advisors and the mutual fund industry experts will argue that the one asset class they want to use active management and open ended mutual funds, is in the fixed income asset class; while I think it has been generally accepted that equity ETFs provide the most efficient way to capture BETA I that market. So, while the above points seem more obvious in relation to the equity markets, I do not think their importance is truly recognized as effectively in the fixed income markets and I want to touch on it briefly.

ETF Mutual Fund

Average Expense Ratio 0.16% 0.60% plus any additional fees

Source: Nerdwallet, Data Current as of July 29, 2022. https://www.nerdwallet.com/article/investing/etfs-vs-mutual-funds

1. Lower internal cost – According to data supplied by NerdWallet.com, the average expense ratio of an ETF is 0.16% vs that average mutual fund expense ratio of 0.60%. While we are not averse to fees, we want to help ensure we are getting value for those fees. S&P Dow Jones SPIVA Scorecard has frequently made the case that higher fees do not amount to better performance [What Is SPIVA? A Closer Look at 20 Years of the Active vs. Passive Debate - Index TV | S&P Dow Jones Indices (spglobal.com)]

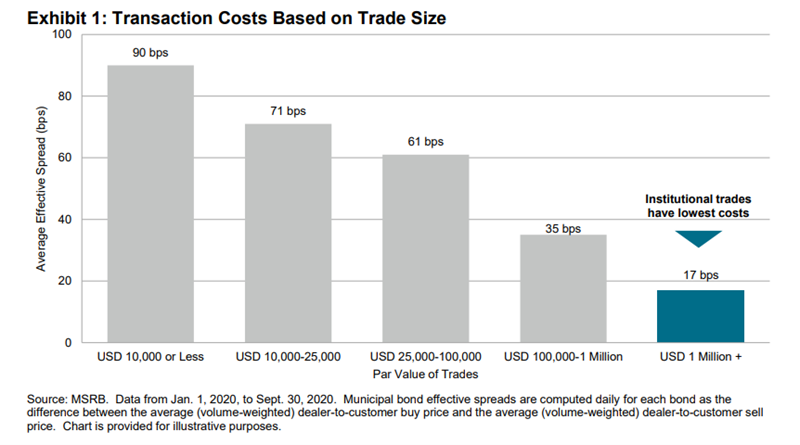

Source: Giordano, Jason. SPDJI. “The hidden Costs of Retail Purchases in Municipal Bonds” June 2022. https://www.spglobal.com/spdji/en/documents/research/research-the-hidden-costs-of-retail-purchases-in-municipal-bonds.pdf#:~:text=From%20Jan.%201%2C%202020%2C%20through%20Sept.%2030%2C%202020%2C,implied%20transaction%20cost%20of%200.17%25%20for%20institutional%20trades.

2. While lower execution costs definitely exist when comparing the ETF category vs Mutual Funds with a load, they may also exist when we compare ETF execution vs. individual security execution costs. Particularly with municipal bonds. S&P Dow Jones Indices has released a number of studies over the years supporting this. The most recent that I am aware of is in June of 2022. The study suggests that a municipal bond implied transaction cost for a retail buyer are 0.72% vs 0.17% for institutional trades [The Hidden Costs of Retail Purchases in Municipal Bonds (spglobal.com)]. The spread becomes even larger as the transaction size becomes smaller. The study also suggests that the costs could potentially be avoided by using ETFs.

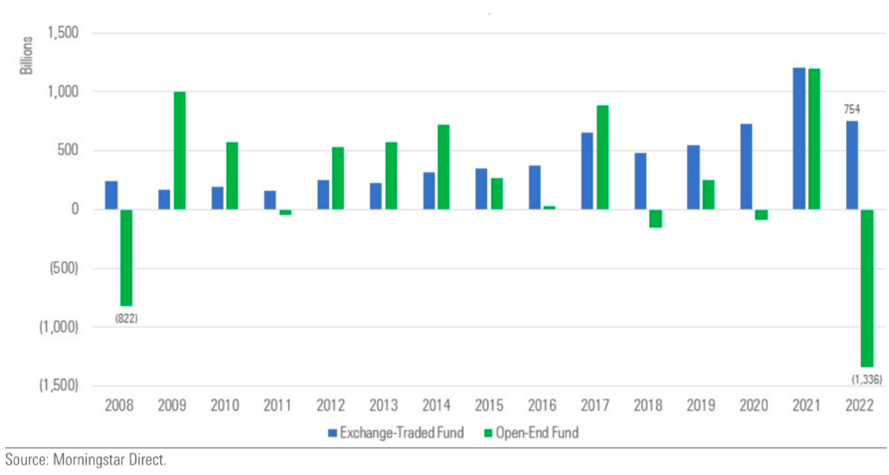

Source: https://www.morningstar.com/views/blog/funds/global-etf-mutual-funds-disparity

3. Tax Efficiency seems rather intuitive, but I do not believe many investors realize the pitfalls of mutual funds. In years like 2022, open ended mutual funds lost $1.3 billion in outflows according to Morningstar [Global Fund Flows: Huge Disparity in ETFs vs. Mutual Funds | Morningstar]. The downside of this is that after decade long run in fixed income, this would potentially leave the remaining investors in those mutual funds with capital gains distributions as open-ended mutual funds would need to liquidate positions to meet redemptions. This is despite the reality that these funds most likely experienced negative performance on the year. Imagine losing money and then receiving a capital gain distribution from your fund.

4. Intraday tradability is a topic that is often spoken about, but rarely appreciated for how important I believe it truly is. This becomes most evident during times of market stress. One notable instance was during the pandemic in March of 2020. The bond market was coming to a standstill, even executing treasury bonds was becoming difficult as liquidity basically evaporated prior to the FOMC providing liquidity measures. Observed intraday swings in bond prices were sometimes in excess of 15%. This was observed most easily with the ETF prices. Many times, they would rise or fall in early trading, then would reverse course on potential news during the day, only to then reverse course again based on new information later that same day. In my opinion, bond ETFs were the only way to effectively adjust portfolio allocation at that moment in time. If you tried to sell individual bonds, particularly corporate credit, there would often be no buyer and if there was, it would be a throw away price because the desks were not willing to take the risk, especially on odd lots. Trying to sell through mutual funds could have been effective, but sellers had no idea where their execution was going to be. With such extreme swings in the fixed income markets, it was a big leap of faith to put a liquidation request in during trading hours, only to hope that the redemption NAV was going to be reasonable in consideration of the extreme volatility.

This could cause major challenges if an investor was selling that mutual fund to fund the purchase of another security, as a drastic decline in the fund price on redemption could prevent the funds from matching up for the subsequent buy. ETFs thrived in this period of extreme volatility. Particularly fixed income ETFs. This is rather ironic as industry critics had cited these kind of conditions as these exact circumstances under which ETFs, notably fixed income ETFs, would falter. We executed fixed income trades in excess of $100 million dollars in line with the market during short market windows during the pandemic. This would have been very difficult or even impossible with a portfolio on individual bonds, especially at that size.

5. Previous business day holdings transparency is essential to effective risk management. Mutual fund holdings reports can often be delayed by 3 to 6 months, whereas passive ETF holdings are up to date as of the previous business day. This means that we can manage risk and take advantage of opportunity more effectively by knowing exactly what we own at any given point in time. During 2022 is when I believe this was more important than ever. For the first time since prior to the Great Financial Crisis, rates were meaningfully rising. It was important that investors knew clearly what their modified and effective durations, credit quality, and asset class exposures were. Having information based on what the fund owned three to six months prior is not going to cut it. This benefit does start to become an interesting point of discussion as managers of active ETFs are seeking ways to delay the reporting of their holdings. Removing one of the major advantages of ETFs.

Source: https://www.morningstar.com/views/blog/funds/global-etf-mutual-funds-disparity

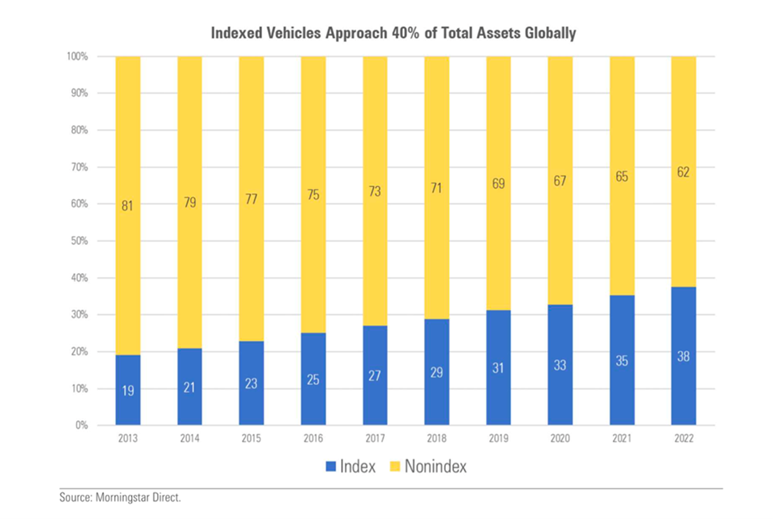

According to Statista [ETFs - statistics & facts | Statista] the number of ETF funds has increased 3,000% since 2003. From 2020 to 2022, $1.7 billion has flowed into indexed funds, while $531 billion has left actively managed accounts according to Morningstar [Global Fund Flows: Huge Disparity in ETFs vs. Mutual Funds | Morningstar]; this now represents 40% of total assets globally.

In my opinion this is with good reason due to the major benefits that ETFs offer for their clients. The portfolio management team at SYKON Capital was an early adopter of ETFs recognizing these patterns and it has been a major attribute to our investment process. While the benefits of ETFs have been increasingly recognized in the Equity assets class for quite some time, I think there is still debate and misunderstanding about the benefits that ETFs bring to Fixed Income asset management.

Despite this rapid growth in Fixed income ETFs, they still only represents about 2% of the overall fixed income market according to Blackrock [BlackRock Projects Global Bond ETF Assets to Reach $5 Trillion by 2030]. I believe this means that there could be tremendous upside and vast opportunities for early adopters of this space.

I do not believe we are ever looking back to using mutual funds for either fixed income or equity ETFs. In fact, I believe the evolution of the fixed income ETF asset class is the single most influential enhancement to the industry in the past decade and will continue to shape this space for the foreseeable future.