INVESTORS: If you are playing the market like a guessing game you are doing it wrong.

If market swings feel like a guessing game, stop what you are doing and put a few simple risk controls into place before going any further.

Last week, I wrote about how the AAII investor sentiment hit its fourth most bearish reading since 1987. Historically, such extreme bearish sentiment has often preceded strong market rebounds, as pessimism reaches unsustainable levels and buying opportunities emerge. Traditionally, that has been a major contrarian buy signal, but given the reality that so many investors are overweight equities, this time it may actually become a self-fulfilling prophecy.

Market Conditions & Investor Sentiment

It didn’t help that the S&P 500 index lost 3.06% last week and is now negative for the year. Headlines about jobs, tariffs, trade wars, and inflation have investors in a panic. While these concerns are valid, history shows that markets tend to adapt and recover as economic fundamentals ultimately drive long-term returns. I’m reading about more and more investors jumping into cash to “stop the bleeding.”

Managing Risk with Objectivity

So today, I want to talk about how to manage risk effectively, turning this guessing game into one of probabilities and objectivity. Whether you’re a short-term trader or a long-term investor, understanding risk management can improve your decision-making and reduce emotional reactions to market volatility. Keep in mind, there are many techniques we can use to manage risk, and depending on your experience and sophistication, you may prefer certain risk management strategies over others.

A Simple Risk Management Technique

Today, I want to discuss a simple technique that almost any investor can implement using free charting software. No one should be losing sleep over their portfolio. These risk management techniques may give you the confidence to know when to adjust your portfolio and when to stay steady.

Moving Averages as a Risk Indicator

A chart you may have seen me use before is a plot of the monthly S&P 500 index along with the 10-month simple moving average, a simple average of the closing price over the previous 10 months.

• Above the moving average: Indicates an uptrend.

• Below the moving average: Suggests a downtrend.

Unfortunately, we can see some noise over time with this type of strategy. There are periods of false positives, meaning our risk controls may get triggered when a quick recovery follows. Fortunately, this type of strategy doesn’t tell you when to sell but rather when to buy as the index moves back above the moving average.

Smoothing the Signals

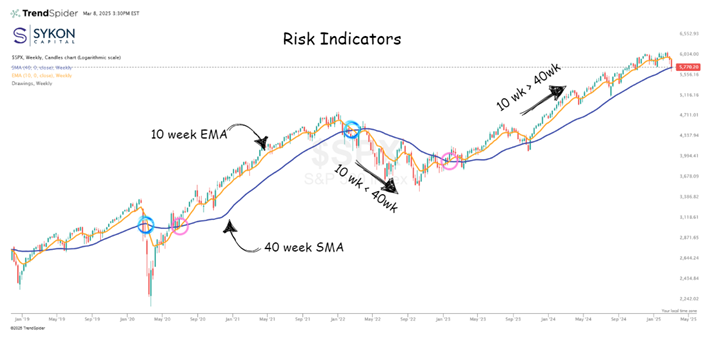

Professional portfolio managers often use smoothing techniques to quiet the noise and identify meaningful signals. In this example, I’ve used a 10-week exponential moving average (EMA) crossing a 40-week simple moving average (SMA).

• 40-week SMA: Represents the long-term trend.

• 10-week EMA: Provides near term trend signals.

Since June 2019, this approach has indicated only two sell signals and two buy signals, during the pandemic and the 2022 sell off. Market fluctuations during other periods were ruled out as simple noise.

What This Means Today

Today, we’re starting to see the 10-week EMA roll over, but it has not yet crossed below the 40-week SMA. This indicates that momentum is slowing, but the uptrend is still intact.

Now, I know what’s coming, the timing-the-market crowd will start chiming in with their usual refrain:

“Time in the market, not timing the market.”

Just stop. The world is not that binary. As professionals, we don’t simply go to cash because one index goes negative.

Finding Opportunities Elsewhere

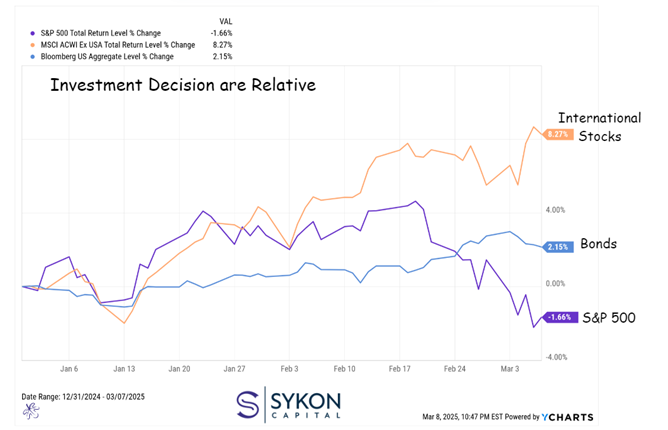

Just because one isolated index isn’t working doesn’t mean there’s no opportunity elsewhere. So far this year:

• International stocks are leading the pack.

• Bonds are in a distant second but still positive.

• Domestic equities are trying to hang on.

If a risk indicator signals that we need to remove a sector, we can scan the market for an index or position that may be in an uptrend. This allows us to stay invested over time while minimizing the risk of riding one particular investment too far down.

Final Thoughts

Hopefully, this process provides clarity on when to enter and exit a position and helps you sleep better at night, knowing you are implementing an objective system based on price rather than reacting to news headlines. No system is perfect, but having a disciplined approach can help filter out noise and improve long-term portfolio risk management.

If you want to discuss how to apply these risk management techniques to your own portfolio, feel free to reach out. I’d be happy to help you build a strategy that aligns with your investment goals.