Is It Too Early To Be Lowering Recession Expectations?

The consensus opinion during the majority of 2022 was that a recession in the United States was imminent, with almost every major financial institution elevating their forecasts for a recession(1,2,3). As the equity market has recovered since October 2022, the recession forecasts have declined substantially. Many economists have recently called for no recession or in the worst-case scenario, a soft landing.

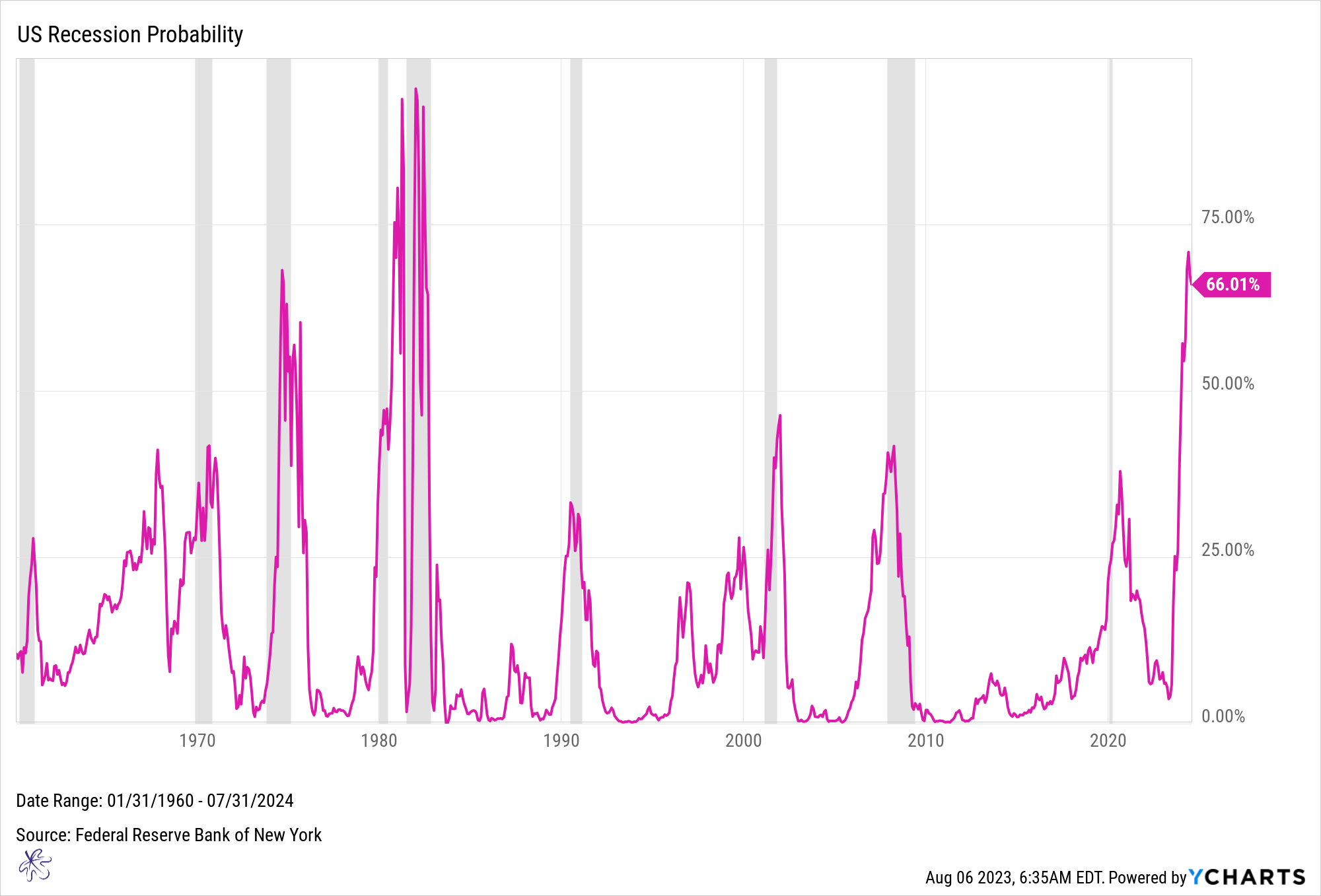

This is despite a deeply inverted yield curve and recession probabilities that are spiking to the highest levels in 4 decades.

These adjustments to recession expectations are starting to hear like chants of, “This time is different”.

But is it too early to be cheering the FOMC for avoiding what once appeared to be our inevitable demise of a second recession in less than 4 years?

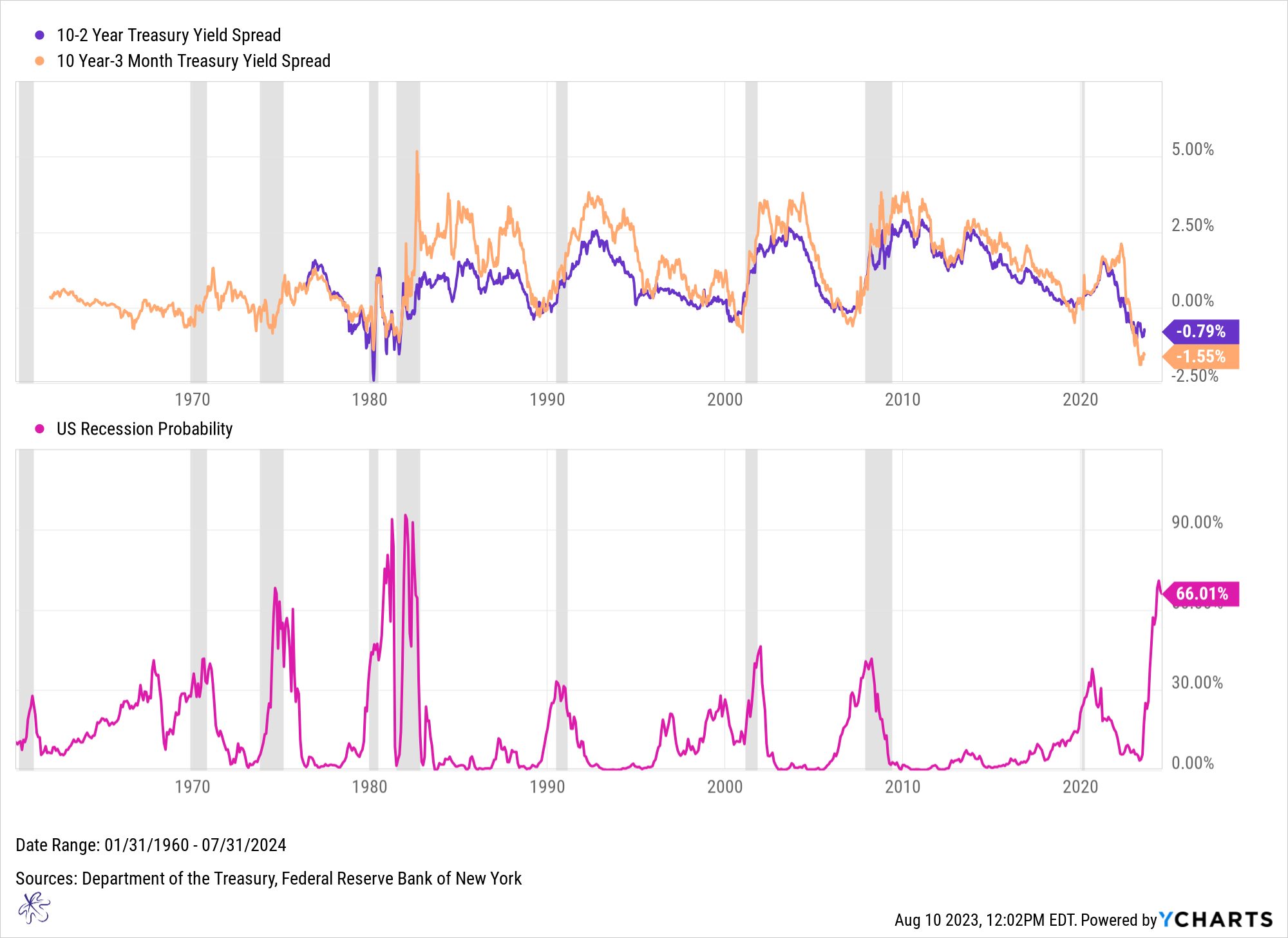

The New York Federal Reserve recession probabilities are derived from the changes on the 10 year minus 3 month (10y3m) United States Treasury Yield Curve. Generally, when the yield curve inverts, recession probabilities rise. In fact, an inversion of the 10y3m curve has proceeded the last nine recessions, so there is a clear inverse correlation between the 10y3m and recession probabilities. Again, as the curve inverts, recession probabilities rise, but you may have noticed that the curve inversion is slightly ahead of the recession. This is because the 10y3m curve projects forward the probabilities by 12 months.

So, the shape of the curve in August of 2023, is projecting recession probabilities in August of 2024. To fully digest how accurate this indicator has been historically, there was a recession probability spike in the late spring of 2020, based on yield curve action from the late spring and summer of 2019. This was nearly a year before anyone even knew what Covid-19 was.

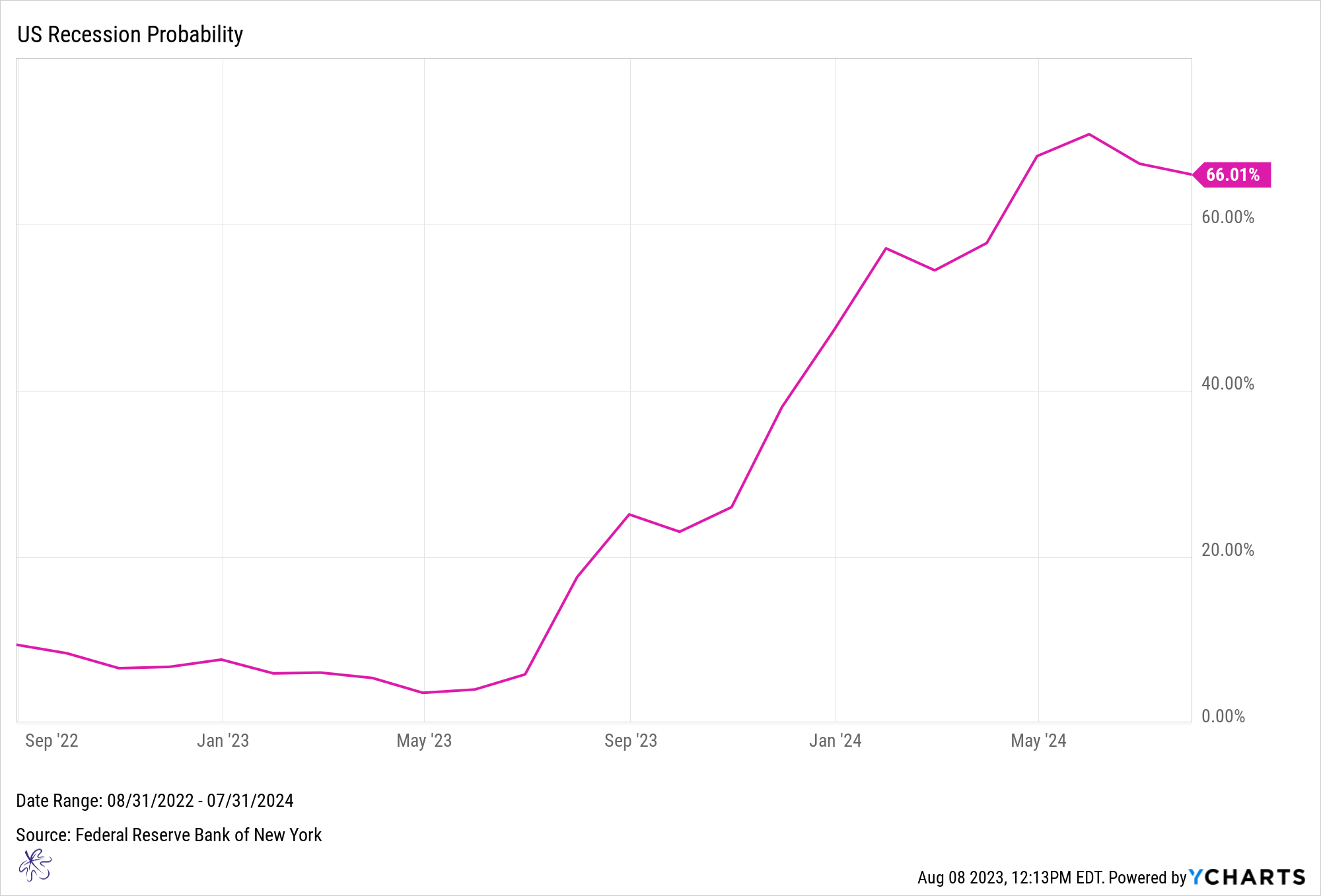

So, while everyone was calling for recession during late 2022 and the first half of 2023, recession probabilities were below the instrumental 10% probability level during this time. They only crossed above the 10% threshold in July, when the probabilities jumped from 5.93% in June to 17% in July. The probabilities quickly spike to a peak of 70.85% in May of 2024, the highest level in over 40 years. Simultaneously, most major institutions are lowering their own risk probabilities.

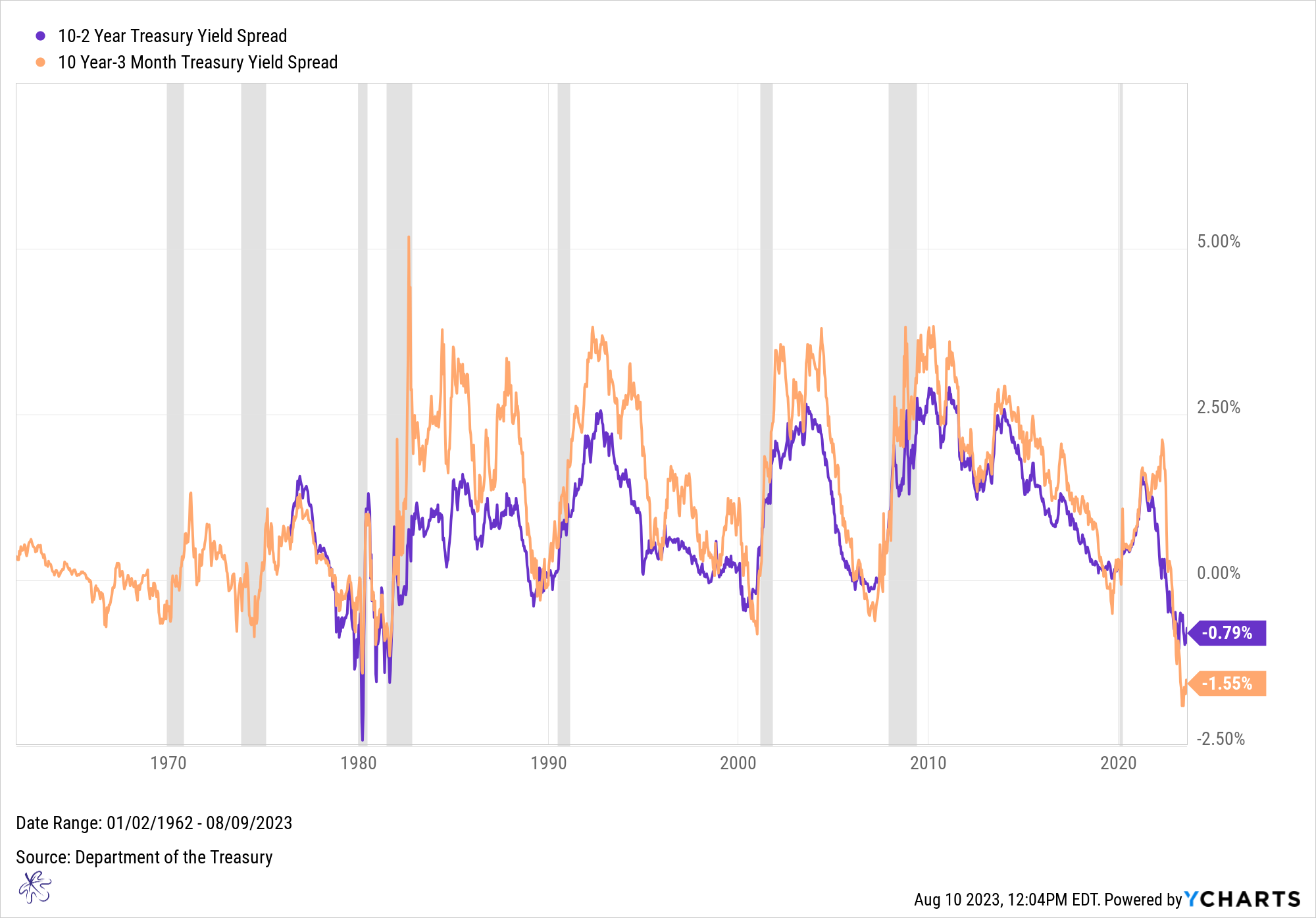

The reality is that the 10y3m yield curve is still inverted and has only recently shown signs of stabilization. At the same time the 10 year minus 2 year (10y2y) curve only stabilized months prior to the 10y3m curve. In the past 8 recessions, indicated by the grey areas on the chart, the recessions did not actually occur until these curves began steepening. The reason that I show the 10y2y along with the 10y3m is because it can provide an indication of the future direction of the 10y3m curve.

Over the past 30 years the purple 10y2y curve has preceded the 10y3m both on the way to inversion and subsequent steepening.

In this current environment, the 10y2y inverted almost 6 months before the 10y3mand began to stabilize about 3 months prior to the 10y3m. As of now, the 10y2y has not made a meaningful move to steepen, which means that we may be at least few months away from the 10y3m starting to steepen.

We believe this is important, because it is unlikely that a recession would have occurred yet based on historical analysis of past recessions. To truly state that this time is different, we need to see these curves steepen and normalize. If this can happen while the economy continues to expand, then this time truly is different.

Until then, the real risk of a recession needs to be respected.

1 7 top economic minds think a global recession is coming soon | Fortune

2 Could the economy avoid a recession despite Fed hikes? - The Washington Post

3 66% worry a recession is coming. What concerns each generation most (cnbc.com)