Navigating Market Trends: The Untapped Potential of Healthcare in a Tech-Dominated Landscape

Discover how shifting our focus from the tech hype to the emerging opportunities in healthcare can redefine portfolio strategy in today's dynamic equity market.

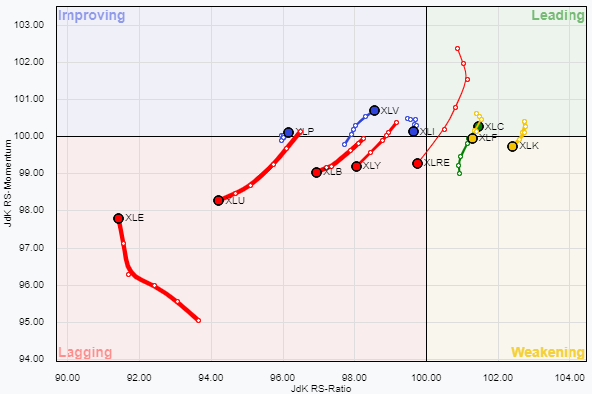

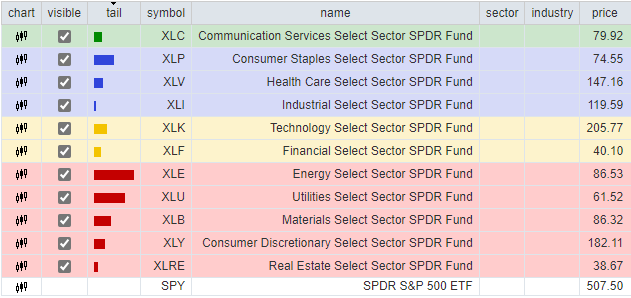

source: Stockcharts.com

In the constantly evolving landscape of the equity market, it's easy to be swept up by the fervor surrounding the technology sector. Its prominence in current news cycles can overshadow other areas of potential growth, notably the healthcare sector. Our aim today is to dig into this opportunity through a familiar lens: the Relative Rotation Graph (RRG).

For those in need of a refresher, RRGs are a powerful tool in our analytical arsenal, allowing us to visualize the performance of various sectors relative to a benchmark, in this instance, the S&P 500 index. Notably, the current leader in the RRG's leading quadrant is the Communication Services sector, buoyed by positive earnings reports from key companies. However, on the horizon, in the improving quadrant, is the healthcare sector, signaling its nascent promise relative to the broader index.

This insight has not gone unnoticed in our portfolio management, prompting an increased allocation to healthcare in recent weeks. It's a testament to the dynamic nature of market sectors and the necessity of a vigilant investment strategy.

Looking further into the RRG, Consumer Staples appears poised to make a significant entrance into the improving quadrant. This potential shift underscores the importance of not just the assets we hold but also those we choose to exclude. Energy and Utilities, for instance, have remained the relative underperformers, aligning with our strategy to underweight these sectors in our portfolios.

Investment management is as much about discipline as it is about selection. At the core of our approach is a commitment to objectivity, letting data—not emotion—guide our decisions. This philosophy is embodied in our rules-based process, emphasizing rigorous risk management. Our risk protocols establish crucial guardrails, helping limit potential exposure to any single sector to help safeguard against potential losses.

In conclusion, while the allure of the technology sector is undeniable, a comprehensive view of the market reveals a spectrum of opportunities, notably within healthcare. It reaffirms our belief in a disciplined, data-driven strategy, emphasizing not just growth but also the prudent management of risk. We believe this balanced approach is essential in navigating the complexities of the equity market, aiming not only for potential gains but also to help aid in the protection of our clients' investments.