Private Credit: Separating Hype from Reality in a Booming Market

Introduction: The Private Credit Boom

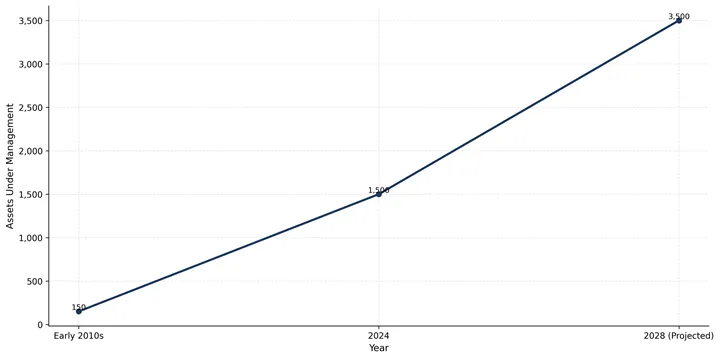

What happens when $2 trillion in loans[1] has never been tested by a recession? That’s the uncomfortable question hanging over the private credit market, one of the financial industry’s hottest growth stories. With projections suggesting the market will balloon to $3.5 trillion by 2028[2], major fund companies are racing to sell this asset class as the next big opportunity. But beneath the glossy marketing materials and impressive growth figures lies a more complicated reality that deserves closer scrutiny, and investors deserve the full truth.The Growth Story: Real, But Context Matters

There’s no denying that private credit has experienced remarkable expansion. The sector has grown nearly tenfold over the past 15 years[2], filling a genuine gap left by traditional banks that retreated from middle-market lending after the 2008 financial crisis. This growth reflects real market dynamics, companies need capital, and banks face regulatory constraints that limit their lending capacity.What’s often glossed over in the industry’s promotional materials, however, is why this growth has been so explosive. Much of private credit’s success story is built on a foundation of historically low interest rates and a benign credit environment. As the Federal Reserve notes, low default rates can be attributed to low interest rates for most of the past 10 years and periodic monitoring of borrowers through loan covenants[3]. The critical caveat? The industry has yet to go through a prolonged recession[3].

Private Credit Market Growth: A Tenfold Expansion

Assets Under Management (USD Billions)

Data Sources and Methodology:

This chart illustrates the dramatic expansion of the private credit market from the early 2010s through projected 2028 levels. The data points represent:

- Early 2010s (~$150B): Baseline reference point derived from the tenfold growth calculation cited in Paul, Weiss 2025 Private Credit Market Outlook[2], which states the market “expanded nearly tenfold to reach $1.5 trillion in 2024.”

- 2024 ($1,500B): Current market size as reported by Paul, Weiss 2025 Private Credit Market Outlook[2] and Morgan Stanley 2025 Private Credit Outlook[2].

- 2028 Projected ($3,500B): Industry projection cited in Paul, Weiss 2025 Private Credit Market Outlook[2], which states “this remarkable growth trajectory is expected to continue, reaching an estimated US$3.5 trillion by 2028.”

The Transparency Problem

Here’s where things get concerning. Private credit operates largely outside the regulatory framework that governs traditional banking and public markets. While proponents tout this as “flexibility,” it creates significant transparency issues that should worry investors.Regulators are taking notice. Fitch Ratings warns that private credit is growing in complexity fueled by evolving structures and asset classes that will require increased transparency and monitoring[4]. The Federal Reserve, International Monetary Fund, and Bank for International Settlements are increasingly scrutinizing private credit’s role in financial markets[5], particularly regarding liquidity mismatches and valuation transparency[5].

The Australian Securities and Investments Commission’s recent discussion paper exemplifies regulatory concerns globally. Its purpose is clear: to flag concerns, increase oversight, and foreshadow potential regulatory intervention should the industry fail to demonstrate adequate transparency[6].

What Should Worry Investors

Several trends in private credit deserve particular attention:Weakening Credit Standards: As private credit funds compete for deals, covenant protections are eroding. The Fed observes that recent deals are devoid of financial maintenance covenants as private credit managers look to compete with banks in the large corporate market segment[3]. These covenants traditionally protected lenders when borrowers faced financial stress, their absence is a red flag.

Untested in Adversity: Analysis of private credit portfolios reveals real world 1-year default risks in the 4.8% – 5.8% range[7]. More troubling, repeat-defaults were marginally more likely in private credit funded borrowers, and the average time span between repeat-defaults is shorter[3] compared to traditional lending. These figures come from a period of relative economic stability, what happens during a real downturn remains unknown.

Liquidity Illusion: Private credit funds often market themselves to retail investors through interval funds and business development companies, creating a dangerous mismatch. These vehicles offer periodic redemption opportunities for inherently illiquid assets. When market stress arrives, this structure could create serious problems for investors expecting access to their capital.

Understanding Default Risk in Context

One of the most frequently cited selling points for private credit is its relatively low default rates. And it’s true, default rates in private credit have been historically low. But this statistic requires critical context that’s often missing from marketing materials.The reality is that private credit’s track record has been built during an exceptionally favorable economic environment. As the Federal Reserve notes, low default rates can be attributed to low interest rates for most of the past 10 years and periodic monitoring of borrowers through loan covenants[3]. More importantly, the industry has yet to go through a prolonged recession[3].

This is not a minor caveat, it’s fundamental to understanding risk. Private credit’s explosive growth occurred during a period of cheap money, accommodating credit conditions, and relatively stable economic growth. We simply don’t have data on how these portfolios perform when credit markets freeze, refinancing becomes difficult, or a sustained economic downturn puts pressure on borrowers.

Making matters more concerning, the credit protections that traditionally helped lenders weather downturns are eroding. The Fed observes that recent deals are devoid of financial maintenance covenants as private credit managers look to compete with banks in the large corporate market segment[3]. These covenants historically gave lenders early warning signs and intervention rights when borrowers faced trouble, their absence means less protection precisely when it’s needed most.

Research also suggests that repeat-defaults were marginally more likely in private credit funded borrowers, and the average time span between repeat-defaults is shorter[3] compared to traditional lending. This pattern raises questions about whether private credit’s underwriting standards and workout processes are as robust as claimed.

The bottom line: Low historical default rates tell us how private credit performed during good times. They don’t tell us how it will perform during bad times, and that’s the information investors actually need to assess risk properly.

Red Flags: What Investors Should Watch For

- Frequent redemption promises on illiquid assets: If a fund offers quarterly or monthly redemptions for inherently illiquid private credit investments, that’s a dangerous mismatch waiting to cause problems during market stress

- Vague or limited portfolio disclosure: Funds that won’t provide detailed information about underlying borrowers, covenant structures, or valuation methodologies are hiding something investors need to know

- Marketing materials that ignore recession scenarios: Any pitch deck that doesn’t address how the portfolio would perform during an economic downturn is selling a fantasy, not an investment strategy

- Aggressive return projections without stress testing: Promised returns such as 10-12% with minimal discussion of default risks or economic sensitivity should raise immediate concerns

- Erosion of borrower protections: Recent deals devoid of financial maintenance covenants[3] mean lenders have fewer tools to protect themselves when borrowers face financial stress

- ‘Too good to be true’ liquidity terms: Private credit is inherently illiquid, any structure claiming otherwise is creating risk that will materialize when you need your money most

What’s Legitimately Promising

To be balanced, private credit does offer genuine benefits in certain contexts. For sophisticated institutional investors with long time horizons and no liquidity needs, private credit can provide:- Higher yields than comparable public market instruments

- Customized financing solutions for middle-market companies

- Diversification from traditional fixed income

Questions Every Investor Should Ask Their Advisor

- “Has this private credit fund been stress-tested for a recession scenario, and can I see the results?” The industry has yet to go through a prolonged recession[3], demand to see modeling that shows how the portfolio would perform with default rates doubling or credit markets freezing

- “What exactly are the covenant protections in the underlying loans, and how do they compare to traditional lending?” With recent deals devoid of financial maintenance covenants[3], you need specifics on what protections actually exist when borrowers face trouble

- “If I need to exit this investment during a market downturn, what’s the realistic timeline and what costs should I expect?” Don’t accept vague answers about “periodic redemptions” - get concrete details about gates, fees, and historical redemption timelines during stress periods

- “How are the assets in this fund valued, who performs the valuations, and how often are they independently verified?” Valuation transparency is a major regulatory concern, if your advisor can’t explain the process clearly, that’s a red flag

The Bottom Line

Private credit isn’t inherently bad, but it’s being sold as something it’s not. The industry’s explosive growth has occurred during an unusually favorable environment - low rates, minimal defaults, and no real stress test. We simply don’t know how these structures will perform when the economic cycle turns, and that uncertainty is being systematically downplayed by firms with billions in fee revenue at stake.Here’s what should concern you most: The major fund companies promoting private credit have built business models that depend on continuous asset gathering. Their fee structures, typically 1.5% management fees (with some funds charging up to 2%) plus 15-20% performance incentives, create powerful incentives to emphasize opportunity while minimizing risk. When regulators from the Federal Reserve, IMF, and Bank for International Settlements are raising concerns about liquidity mismatches and valuation transparency[5], and when Fitch Ratings warns about growing complexity requiring increased monitoring[4], investors should be asking why their advisors aren’t having these same conversations.

The questions you ask matter. The disclosures you demand matter. The willingness to walk away from investments that can’t provide clear answers about recession scenarios, covenant protections, and valuation methodologies, that matters most of all.

Private credit represents a fundamental shift in how corporate lending works, and like any major market evolution, it carries both opportunities and risks. The difference is that traditional banking operates under regulatory scrutiny with transparent pricing and standardized protections. Private credit operates in the shadows, and that opacity benefits sellers far more than buyers.

The industry would benefit from greater transparency, stronger investor protections, and honest conversations about downside scenarios. Until that happens, the burden falls on you to ask the hard questions, demand real answers, and recognize when you’re being sold a story instead of an investment.

Your capital, your risk, your responsibility to see through the hype.

[1] Top Private Credit Trends and Outlook for 2025 | Dec...

[2] [PDF] 2025 Private Credit Market Outlook - Paul, Weiss

[3] The Fed - Private Credit: Characteristics and Risks

[4] Complexity, Regulatory Scrutiny to Grow in Private Credit

[5] Private Credit’s Surge Has Investors Excited and Regulators ...

[6] Private credit market put on notice: A time for reflection and maturity

[7] Understanding Private Credit Risks: Default Trends, Systemic ...

Advisory Services offered through SYKON Capital LLC, a registered investment advisor with the U.S. Securities and Exchange Commission. This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. The information contained in this presentation has been compiled from third party sources and is believed to be reliable as of the date of this report. Past performance is not indicative of future returns and diversification neither assures a profit nor guarantees against loss in a declining market. Investments involve risk and are not guaranteed.