Risk Isn’t a Chart. It’s Your Life.

While everyone else is busy arguing about charts and 2026 market predictions, the real risk most families face has nothing to do with where the S&P 500 goes next.

Risk shows up when markets fall at the same time life demands certainty, income, or flexibility you no longer have.

It looks less like volatility and more like lost choices, forced moves, and conversations you never expected to have.

We talk about risk all the time in this industry. I do it. Other advisors do it. Portfolio managers do it. In reality, we usually do a terrible job explaining what risk actually means.

We hide behind numbers. Standard deviation. Drawdowns. Volatility. Worst year. Best year. All technically correct. All emotionally meaningless.

Because risk is not a percentage.

Risk is not a chart.

Risk is not a line on a performance report.

Risk is what happens to your life when things break.

And that distinction matters more than ever right now.

I spend most of my time focused on managing the downside. Not because I’m pessimistic. Not because I hate growth. But because if you manage the downside well enough, the upside tends to take care of itself over time. Big drawdowns are what permanently damage plans. They are what force bad decisions. They are what take options away.

What frustrates me is how abstract this conversation has become. Everyone wants to talk about maximizing returns. Very few people want to talk about the consequences when those returns don’t show up exactly when you need them.

And those consequences are real.

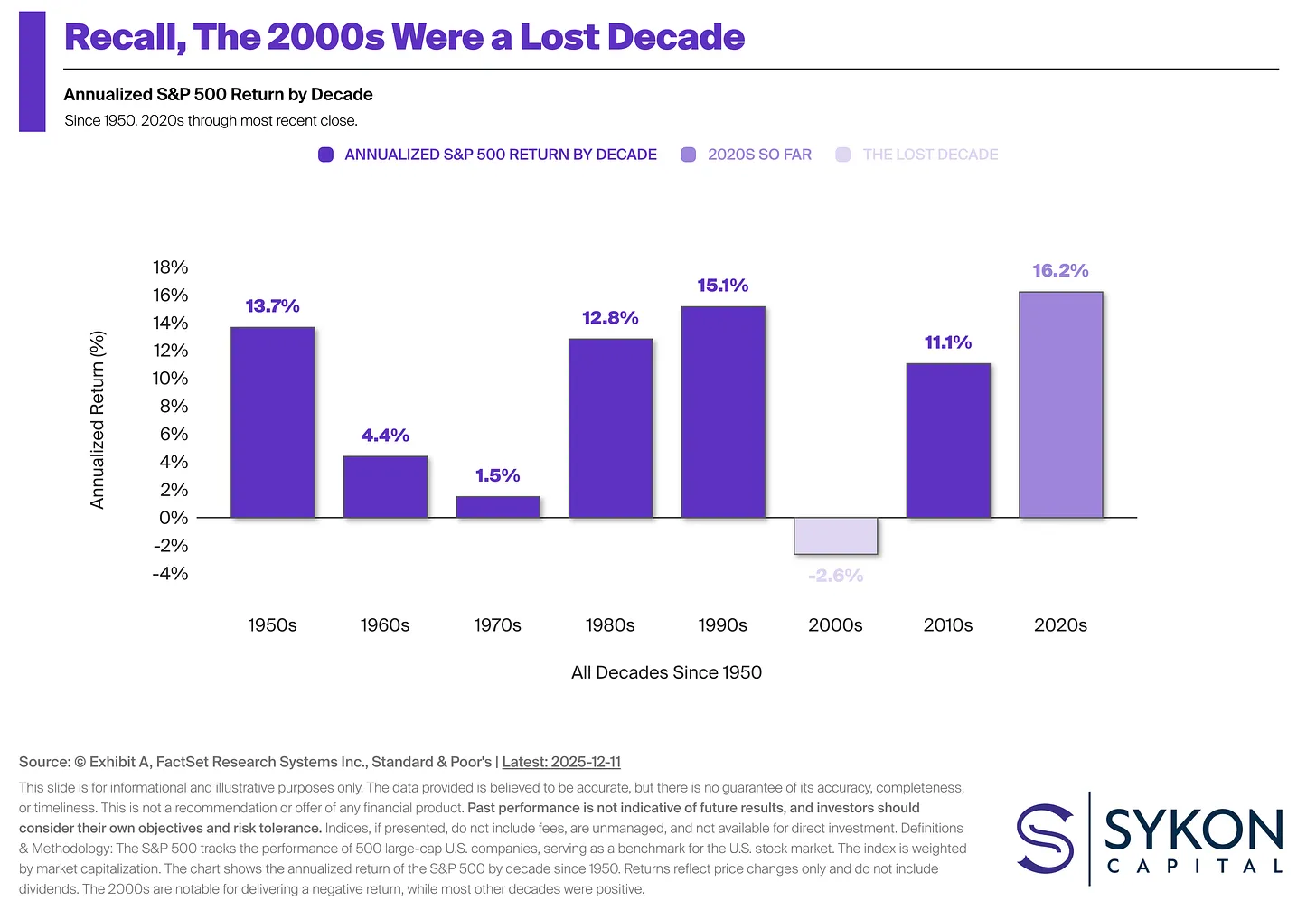

We’re coming off an extraordinary period in market history. A 13 to 15 year secular bull market depending on how you want to measure it. Yes, we had 2020. Yes, we had 2022. But those were corrections inside a larger upward trend. If you zoom out, the story is simple. Returns have been strong. Very strong.

That has a funny effect on people.

When markets reward risk for a long time, people start believing risk doesn’t exist. Or worse, that risk is something that only shows up in textbooks or old charts from the 1970s.

But history doesn’t work that way.

Strong periods are often followed by weak ones. The 2000 to 2010 period was essentially a lost decade. Negative real returns. The 1970s produced single digit nominal returns with brutal inflation underneath. Long stretches where doing nothing clever felt smart, until it wasn’t.

What worries me today is how many plans I see that technically only need 3 to 5 percent annual returns to succeed, yet are positioned like they need to hit home runs every year.

Why? Because people have been spoiled.

From 2010 through 2020, and again from 2020 through today, returns were well above what most long-term plans actually require. Instead of locking in progress, many people keep reaching. More concentration. Less diversification. More faith that whatever worked recently will keep working.

That is how risk quietly builds.

This isn’t theoretical for me.

I went to college in the fall of 2000. Right at the peak of the dot com bubble. My parents had worked hard and saved money for college. They got advice to keep that money invested in high growth, internet focused funds instead of using it to pay tuition.

The market didn’t cooperate.

Those stocks collapsed over the next few years. Many never recovered. The money that was supposed to fund education evaporated. We made it work. We took on loans. We adjusted. We were fortunate.

Not everyone was.

I remember a close friend who got into their dream school. The one they worked their entire life to attend. After freshman year, their parents lost their business and their savings in the dot com crash and subsequent recession. They had to sit their child down and explain that going back wasn’t possible. They transferred to a more affordable school that was less than ideal. Not because they wanted to. Because they had no choice.

That is risk.

I saw it again during the financial crisis. A friend bought a home in 2006. Lost their job. The condo dropped from roughly $600,000 to the low $300,000s. Three kids in a 2 bedroom home. No equity. Savings wiped out in the market. No mobility. They couldn’t sell. They couldn’t stay. They had to uproot their entire life and move south just to survive.

That is risk.

Risk is not losing money on paper. Risk is losing options. Risk is being forced to make decisions you never wanted to make at the worst possible time.

And here’s the part that matters most.

This is not inevitable.

Markets will cycle. Drawdowns will happen. But the severity of how those drawdowns affect your life is not something you’re powerless over. You do not have to just sit there and absorb whatever the market hands you.

There are proactive choices that can be made. Choices around diversification. Around position sizing. Around how much risk you actually need to take versus how much you’ve simply gotten comfortable taking. Choices that recognize where you are in life, not just where markets have been.

Managing risk does not mean eliminating it. It means acknowledging it before it shows up. It means planning for scenarios instead of assuming continuity. It means accepting that protecting progress is just as important as chasing growth.

I don’t know when the next real bear market shows up. Next year. Five years. Ten years. No one does. But I know this much. Something eventually breaks. It always does.

If you’re still working and saving, you have time to recover. If you’re approaching retirement or already drawing from your portfolio, the math changes completely. Big drawdowns early in retirement can permanently alter outcomes. There is no paycheck coming in to rebuild. Losses compound in the wrong direction.

This is not about predicting markets. It’s about respecting reality.

As we head into 2026, I’m asking people to pause. Look at how far you’ve come. Look at the tailwind you’ve benefited from. And stop benchmarking your future against the most generous period in market history.

Your plan does not care what the S&P 500 does. It only cares about your personal rate of return. What do you need to fund your life, your family, your goals?

Anything beyond that is optional risk. And optional risk is exactly that. Optional.

This isn’t complex. It’s just uncomfortable. It requires a proactive mindset. It requires moving before you’re forced to move. It requires resisting the idea that the only way to invest is to fully absorb every market drawdown and hope for the best.

Because risk, in the real world, rarely shows up as volatility on a chart. It shows up as lost choices, forced moves, and conversations you never expected to have.

I’ve seen what happens when risk is misunderstood. Personally. Professionally. Repeatedly.

You don’t have to accept it as inevitable. You don’t have to wait for the lesson to be taught the hard way.

Risk is real. But so is your ability to manage it.

Advisory Services offered through SYKON Capital LLC, a registered investment advisor with the U.S. Securities and Exchange Commission. This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. The information contained in this presentation has been compiled from third party sources and is believed to be reliable as of the date of this report. Past performance is not indicative of future returns and diversification neither assures a profit nor guarantees against loss in a declining market. Investments involve risk and are not guaranteed.