Stagflation: has the horse already left the barn?

The Fed won’t say “stagflation,” but their latest comments reveal just how close we might be.

In recent weeks, a clear message has emerged from the Federal Reserve: they are walking a tightrope. Balancing the battle against inflation with a slowing economy and labor market softness is no easy task. While they haven’t used the word “stagflation,” their comments are increasingly painting that picture, especially as tariffs resurface as a potential driver of higher prices.

While markets welcomed the news that the U.S. and China agreed to temporarily slash tariffs, the economic damage may already be done. Inflation is entrenched, growth is slowing, and the Fed’s recent comments suggest the horse may have already left the barn.

This creates a particularly treacherous landscape for small businesses, which are often the first to feel the squeeze when margins compress and consumer demand softens. The Fed’s rhetoric suggests we may be entering a period that looks and feels a lot like stagflation, even if they won’t say it out loud.

The Inflation-Tariff Dilemma

Federal Reserve Chair Jerome Powell put it bluntly during a May 7th appearance:

“If the large increases in tariffs that have been announced are sustained, they’re likely to generate a rise in inflation, a slowdown in economic growth and an increase in unemployment.”

(CNN)

This reflects the growing concern that tariffs, while politically expedient, function like a tax on consumers and businesses alike, driving up costs across the supply chain. For the Fed, which is tasked with keeping inflation in check while maintaining full employment, this creates a policy trap.

Governor Christopher Waller reinforced that view in a recent speech:

“While I expect the inflationary effects of higher tariffs to be temporary, their effects on output and employment could be longer-lasting.”

(FederalReserve.gov)

With prices still elevated and growth slowing, monetary policy is being asked to do too much with too few tools.

The Unspoken Risk: Slowing Growth, Rising Prices, and the Fed’s Quiet Alarm

There’s a growing undercurrent in recent Fed commentary, a warning that doesn’t use the word, but unmistakably describes the symptoms: slowing economic growth, persistent inflation, and a labor market that’s beginning to show signs of strain.

Powell framed it carefully, saying:

“We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension.”

(macenews.com)

That’s central bank-speak for: “We might not be able to fight inflation without hurting jobs.”

Cleveland Fed President Beth Hammack took a similar line in an April 16th appearance:

“There is a strong case to hold monetary policy steady in order to balance the risks coming from further elevated inflation and a slowing labor market.”

(Reuters)

This cautious tone signals a quiet admission: the Fed is now trying to manage two problems moving in opposite directions. When inflation is sticky, but growth is stalling, monetary policy becomes a blunt, and potentially dangerous, instrument.

For small businesses, this is an especially toxic combination: rising input costs, higher borrowing rates, and weakening demand. The signs are all there. The Fed won’t say “stagflation,” but the environment they're describing is increasingly indistinguishable from it.

We’ve seen this movie before.

The last time the U.S. economy faced a similar mix of high inflation, sluggish growth, and rising unemployment was in the 1970s, a period now infamous for its economic stagnation. Back then, oil shocks and expansive fiscal policies fueled runaway prices, while industrial output and job creation slowed dramatically.

The result was a decade marked by persistent inflation, wage pressure, and policy paralysis. It took painful rate hikes under Fed Chair Paul Volcker in the early 1980s to finally break the cycle, at the cost of a deep recession. For many economists and investors, it remains a cautionary tale of what happens when inflation is allowed to entrench itself while growth stalls.

The Fallout for Small Businesses

Small businesses, often with thinner profit margins and less pricing power, are uniquely exposed. As tariffs inflate the cost of goods, these firms are forced to choose between absorbing the costs or passing them onto increasingly cost-sensitive consumers.

New York Fed President John Williams offered a subtle warning in this vein, stating:

“There are early signs consumers are starting to pull back on spending.”

(MarketWatch)

That spells trouble for Main Street. If consumer demand falters while costs stay elevated, small business owners face a one-two punch with little room to maneuver.

The Fed’s Strategic Patience and Its Limits

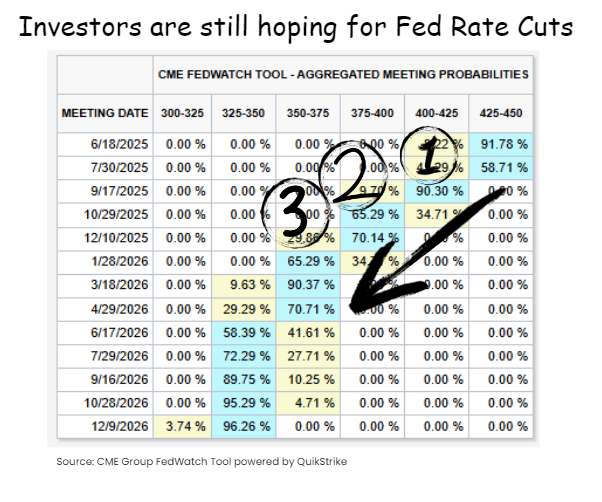

To their credit, Fed officials are showing restraint. By holding the benchmark interest rate steady between 4.25% and 4.5%, the central bank is buying time to assess how the data evolves. But make no mistake, the room to maneuver is shrinking.

Yet, investors are still hoping for three rate cuts through January of 2026, despite the FOMC’s warnings.

In a policy environment where inflation won't yield and the labor market is no longer bulletproof, standing still might be the only option left. It’s less about making the “right” move and more about avoiding the wrong one.

Conclusion: No One Wants to Say It, But Everyone Feels It

While the Fed may never use the word “stagflation” in public remarks, their messaging increasingly reflects the risks associated with it: inflation that won’t go away, paired with a softening labor market and weakening growth. It’s a perilous mix for policymakers, and a brutal one for small business owners.

The question isn’t whether the Fed sees the warning signs. They do.

The question is: What tools do they have left that don’t make the problem worse?

If there’s a silver lining, it may lie in the government’s ability to promote growth through smart, targeted deregulation, reducing friction for businesses trying to adapt in a high-cost environment. In a stagflation-like scenario, removing barriers to productivity could prove more effective than relying on monetary policy alone.