THE Chart to Watch

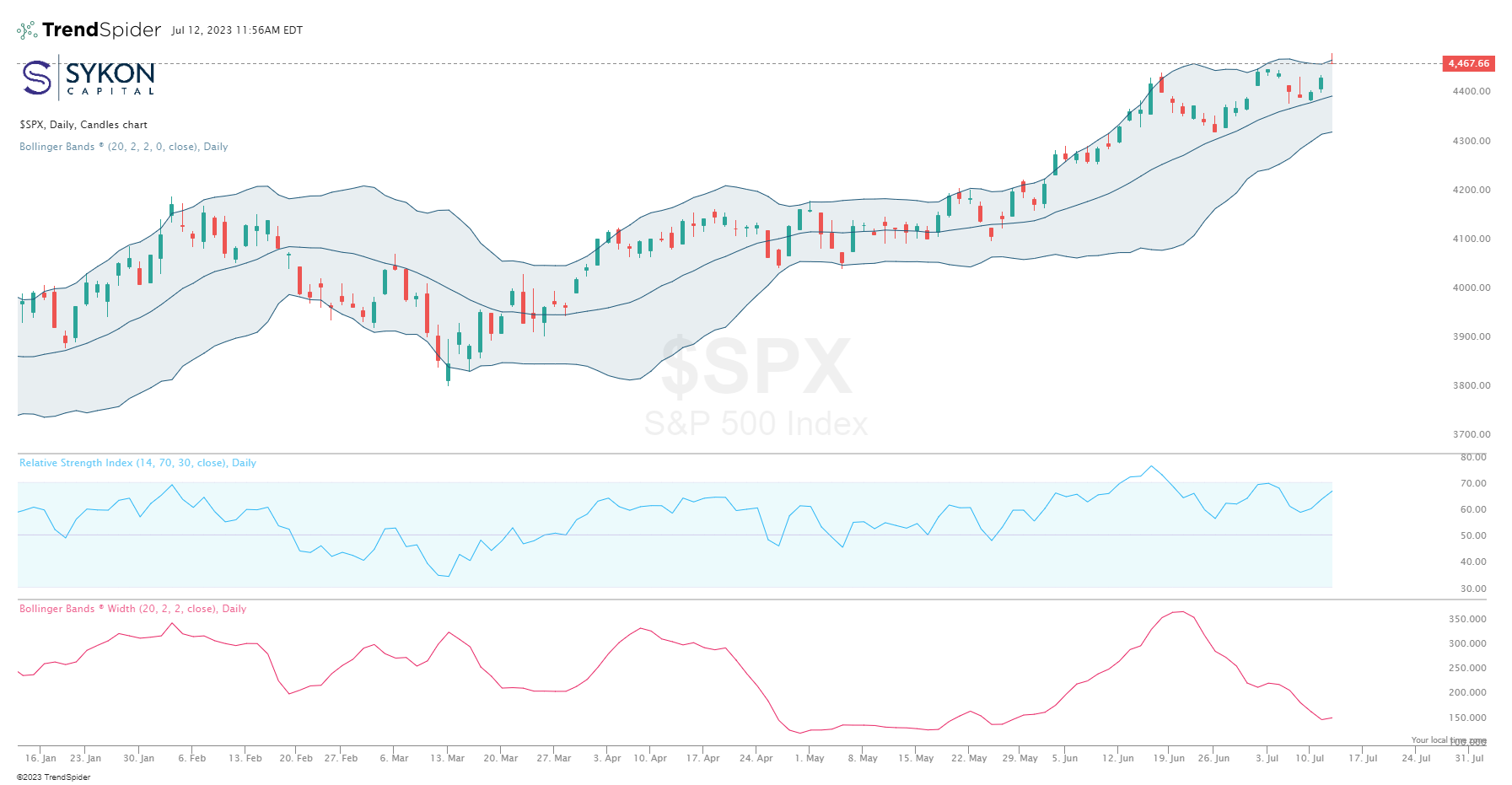

With the recent talk out of the media outlets this past week, we wanted to help filter through the noise and focus on the signals. In the past few days, the S&P500 index has pulled back from overbought conditions as indicated by the RSI falling below 70 on July 3rd. Today the index is trading right around 4,480 as of 11:15am EDT. The index closed at a recent high of 4,450.38 on June 30th, higher than the June 15th peak of 4,425.84 and an RSI level of 76.36. The RSI on June 30th was lower at 69.21. As of 11:15 am EDT, the RSI was right around 68.

This is a classic bearish divergence from overbought RSI levels, with a higher high on the index price and a lower high on the RSI. The S&P500 has since moved up against the upper Bollinger Band today at 4,478. If it closes at this band or above, it could start to ride the upper band higher. Similar to what happened from June 2nd to June 16th.

A failure to hold or break the upper band, could put the middle band at 4,401 back in play. A break below this could result in a move to the lower band at 4,325. This is what occurred from February 21st to March 13th. These sustained trends are particularly prevalent after the Bollinger Band width narrows, like it has recently, and then expands.

Ideally, the RSI needs to reset after the recent overbought conditions, and it would not be unusual for it to settle in around the 50 level before resuming any kind of upward movement.

Remember, overbought and oversold conditions can be relieved through either price or time, and often it is a combination of each. While a further pullback is possible, we may simply need to reset at these levels for a moment.