The FOMC teaches us an important lesson about the true meaning of RISK.

On Wednesday, Janaury 31, the Federal Open Market Committee (FOMC) left rates unchanged, aligning with expectations. However, they upended the base case scenario that many anticipated—a 25 basis point cut in March. This move prompts us to reevaluate our understanding of risk and its true meaning in the financial landscape.

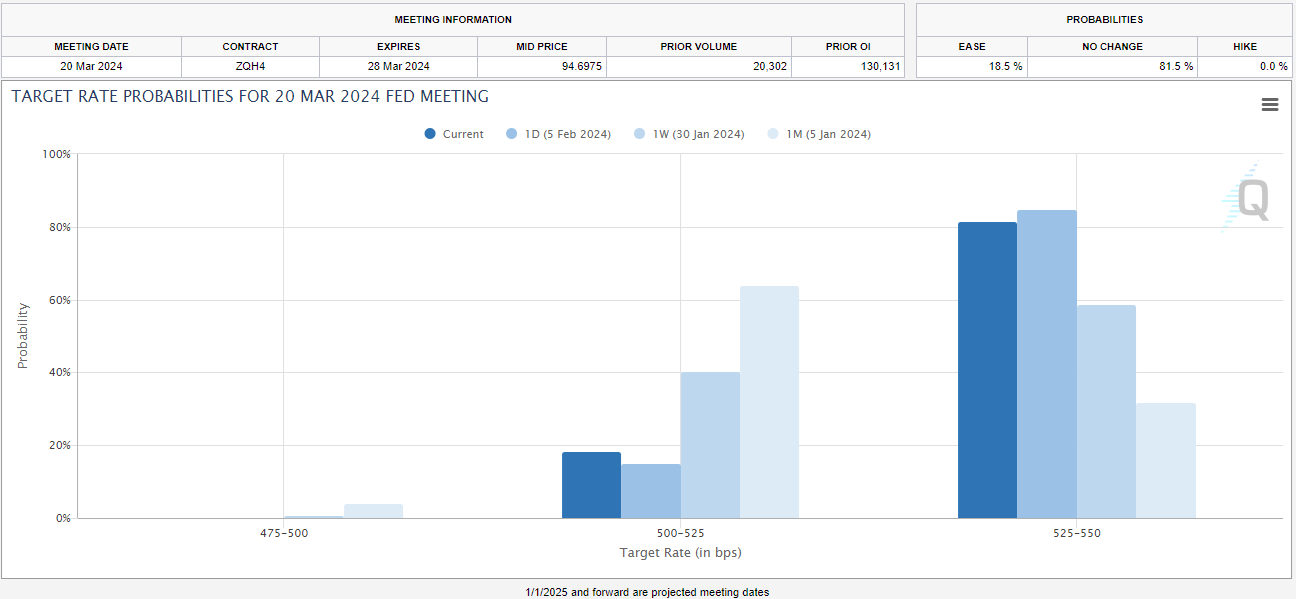

Source: CME Group https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

On Wednesday, the Federal Open Market Committee (FOMC) decided to keep the Federal Funds rate steady at 5.25%-5.5%, as was widely anticipated. Despite this, the Nasdaq experienced a significant drop of over 2% on the same day. The decline was largely attributed to comments made by Jerome Powell from the FOMC, who indicated that a rate cut in March, which the market had been eagerly anticipating, was unlikely.

The above chart visualizes the evolving market expectations over time through a series of bars: light blue for expectations one month ago, a darker shade for one week ago, even darker for one day ago, and the darkest blue representing today's expectations.

As of Janaury 5, 2024, the market had been pricing in a 64% chance of a 0.25% rate cut in March. However, today's figures show only a 18.5% likelihood of such a cut. This significant shift in expectations has led to the market's reassessment from an initially optimistic rate outlook, which we believe is a key factor behind the Nasdaq Composite index's notable drop on the day along with significant volatility in the treasury markets.

However, this article aims to pivot the focus away from the FOMC's actions, which have been extensively covered by other publications, to a broader discussion on risk.

Let's start by defining risk. What really constitutes risk?

Ask most individual investors, and they will say it's the amount of money you can lose.

In contrast, institutional investors might describe risk as the standard deviation of returns or portfolio volatility.

However, true risk arises from the discrepancy between expectation and reality. This implies that a deep understanding of market expectations is crucial before we can identify where potential mismatches may occur.

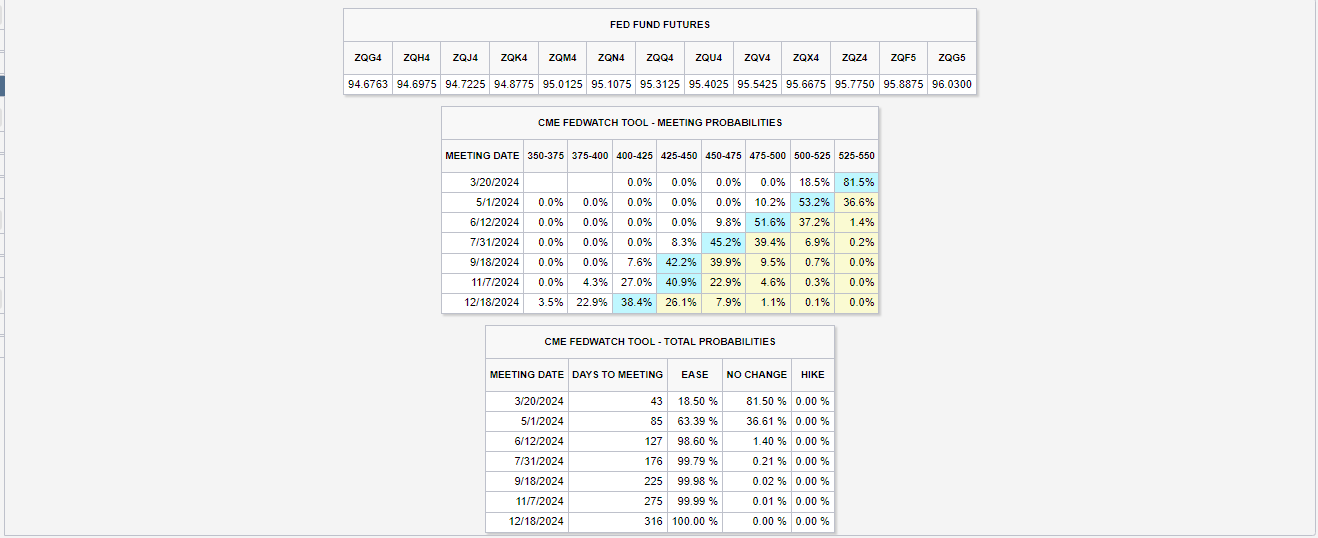

Source: CME Group https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

Let's start by defining risk. What really constitutes risk?

Ask most individual investors, and they will say it's the amount of money you can lose.

In contrast, institutional investors might describe risk as the standard deviation of returns or portfolio volatility.

However, true risk arises from the discrepancy between expectation and reality. This implies that a deep understanding of market expectations is crucial before we can identify where potential mismatches may occur.

Considering this context, do you think the market would react more strongly if the FOMC's decisions were to fall below or exceed these baseline expectations?

In the scenario described, market volatility is likely to escalate with an adjustment that anticipates rates will be high than the expectations, primarily because fewer participants have incorporated such an outcome into their market pricing. It's challenging to predict whether this will lead to downside or upside volatility, but the variability in prices is expected to increase as a greater number of participants are forced to significantly adjust their expectations away from their original anchor points.

This situation underscores the importance of not relying solely on a single data point to guide our risk management decisions. Alongside the growing anticipation of an FOMC rate cut, there emerges inevitable speculation that a recession may be avoided.

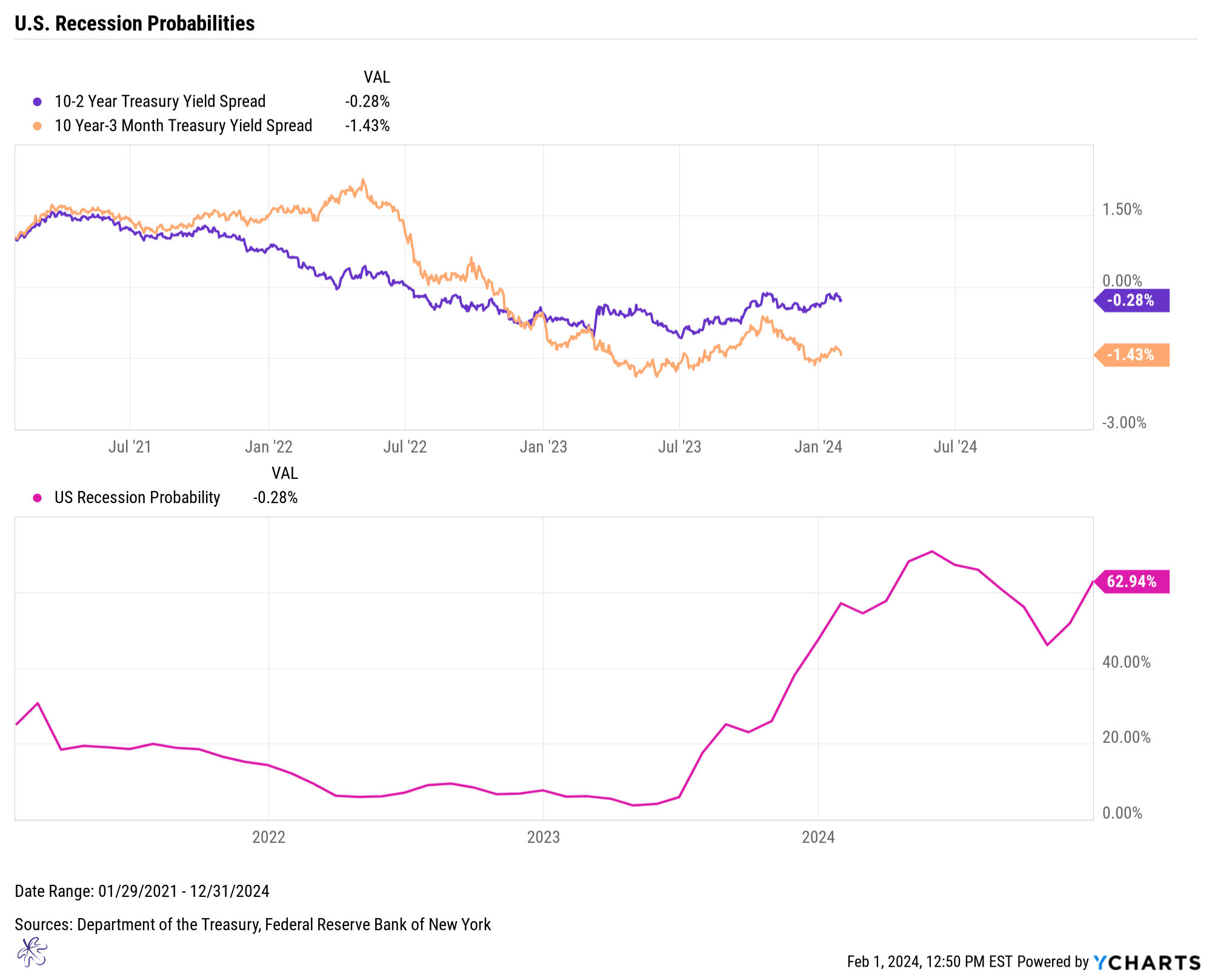

However, this introduces another extreme expectation into the market, where the majority of investors are dismissing the risk of a recession. As I have emphasized on numerous occasions, it remains premature to conclusively rule out the possibility of a recession. This caution reflects a broader understanding that true risk management involves considering a range of outcomes and not being overly swayed by prevailing market sentiment or specific data points.

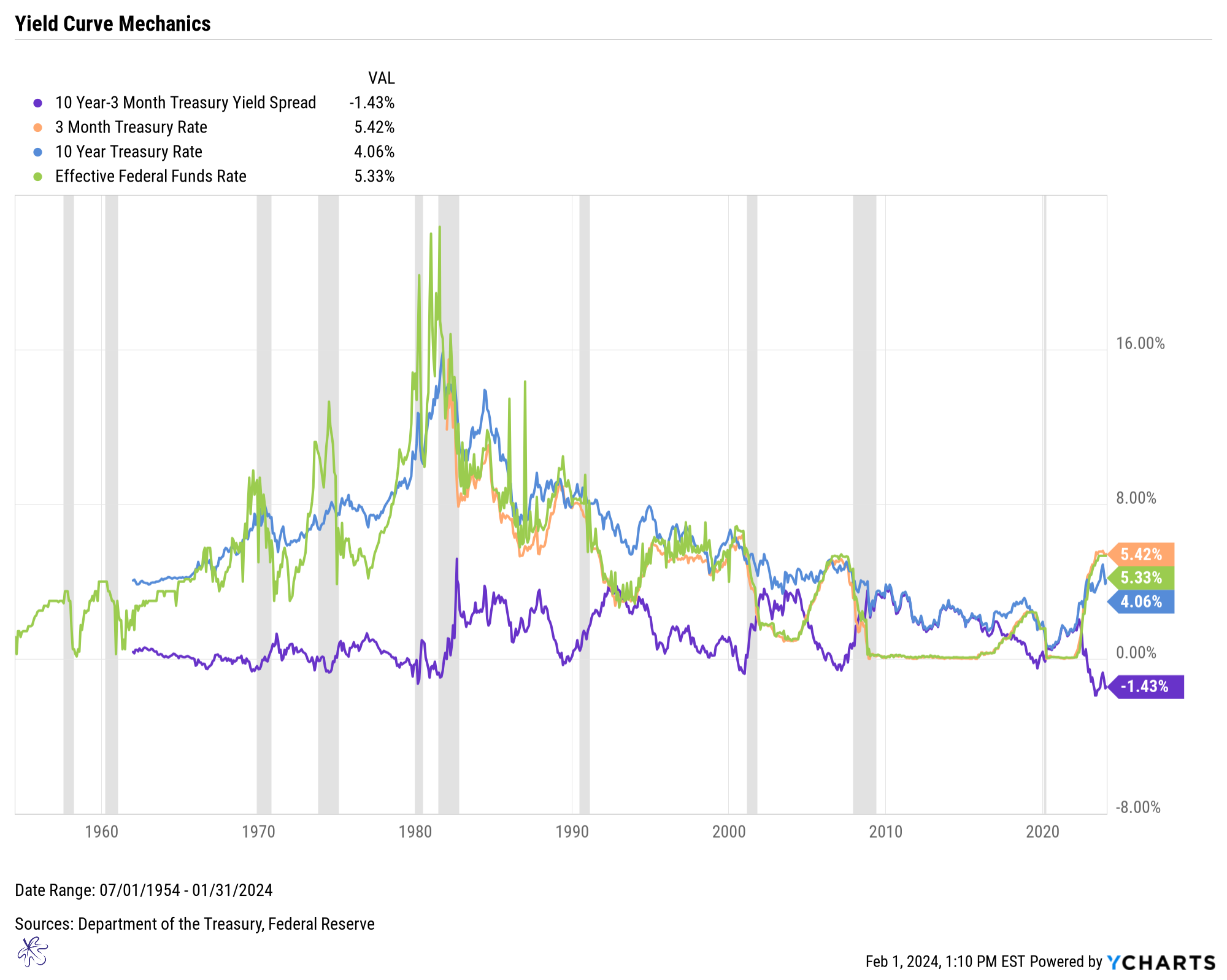

Indeed, the yield curves are currently inverting further, which signals an increase in the future probabilities of a recession. Some speculate that this yield curve could normalize if the long end of the rates increases while the short end remains stable. However, this scenario may not align with historical patterns of curve normalizations.

Typically, a yield curve inversion—where short-term interest rates exceed long-term rates—has been a reliable indicator of impending economic downturns. The expectation that the long end of the curve might rise, while the FOMC maintains elevated current short-term rates, suggests a deviation from the norm. Historically, curve normalization often occurs with a policy shift or changes in economic outlook that affect both ends of the curve.

The speculation around the curve normalizing through an increase in long-term rates, without corresponding rate cuts from the FOMC, presents an interesting scenario. It raises questions about the potential for divergence from historical trends and what this could mean for future economic conditions. This situation highlights the complexity of predicting economic movements and underscores the importance of closely monitoring a range of indicators, rather than relying on a single metric or trend for decision-making.

In the past, yield curve normalization has typically resulted from the front end of the curve dropping more rapidly than the long end, largely influenced by Federal Reserve policy. However, it's important to note that when the FOMC begins cutting short-term rates, it often coincides with the onset of a recession.

This brings us back to the critical analysis of risk, specifically the potential mismatch between market expectations and actual economic outcomes.

The current market consensus is optimistic, anticipating that we will avoid a recession and that the FOMC will begin to reduce interest rates by 25 basis points per meeting starting in May.

Historically, however, recessions have occurred during periods of yield curve normalization, characterized by the front end of the curve's yields declining more rapidly than those at the long end. This trend was observed during previous periods of FOMC rate cuts, where the initiation of cuts at the front end led to a decline in the long end as well, though at a slower pace.

With the 10-year Treasury yield currently around 4.09%, the CME FedWatch Tool indicates a 63.5% probability that the Fed Funds rate will be between 375-425 basis points by the end of 2024. If the 10-year Treasury yield remains stable while the front end declines in line with market expectations, we're looking at a flat yield curve in December 2024.

For the FOMC to claim success in achieving a soft landing, they must normalize the yield curve without triggering a recession. Mathematically, this suggests a challenging journey ahead.

I hope the recession indicator proves incorrect this time, hoping "this time is different." While I am not making a definitive call, the recent FOMC announcement serves as a crucial reminder to manage emotions and maintain objectivity. For now, it's wise to stick with the trend, but be aware that the best-case scenario for rates may already be integrated into market expectations. Therefore, be prepared for how swiftly the situation could change if the anticipated rate cut path is altered.

It's essential to remain disciplined and vigilant as we navigate the path ahead, always prepared for shifts in the economic landscape.

We believe the financial landscape is at a pivotal juncture, marked by the Federal Reserve's strategic decisions and the complex interplay between market expectations and economic realities. The recent developments and discussions surrounding the FOMC's stance on interest rates, coupled with the evolving dynamics of the yield curve, underscore the intricate nature of risk management and the critical importance of aligning expectations with potential economic outcomes.

The current consensus—optimism regarding the avoidance of a recession and anticipation of gradual rate cuts—faces the historical backdrop of recessions coinciding with yield curve normalizations and the nuanced implications of Federal Reserve policies. This scenario challenges investors and market participants to navigate with caution, informed by both historical insights and the present economic indicators.

As we look ahead, the call to manage emotions, remain objective, and adhere to disciplined investment strategies becomes ever more relevant. The possibility of a divergence from expected paths highlights the need for vigilance and flexibility in response to new information and market shifts.

Ultimately, while we hope for a departure from historical patterns that associate yield curve movements with economic downturns, the importance of preparedness cannot be overstated. By staying informed, disciplined, and responsive to the unfolding economic narrative, investors can navigate the uncertainties of the financial markets with greater confidence and strategic foresight.

- Todd Stankiewicz