The Impact of Elevated Stock and Bond Correlations on Asset Allocation

Traditional stocks and bonds have low or even negative correlations. But how do you properly diversify a portfolio when this correlation is at the higher level in over 2 decades?

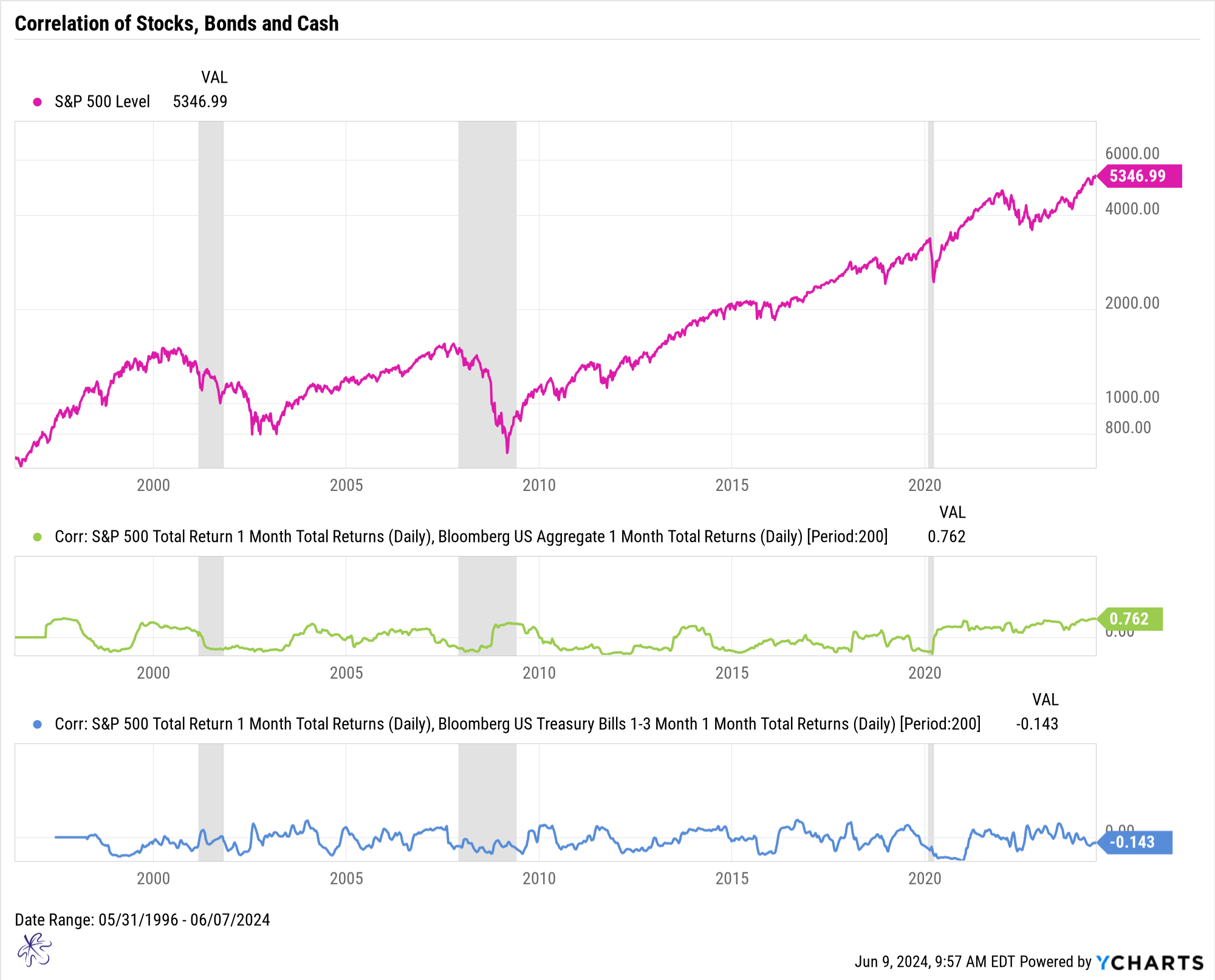

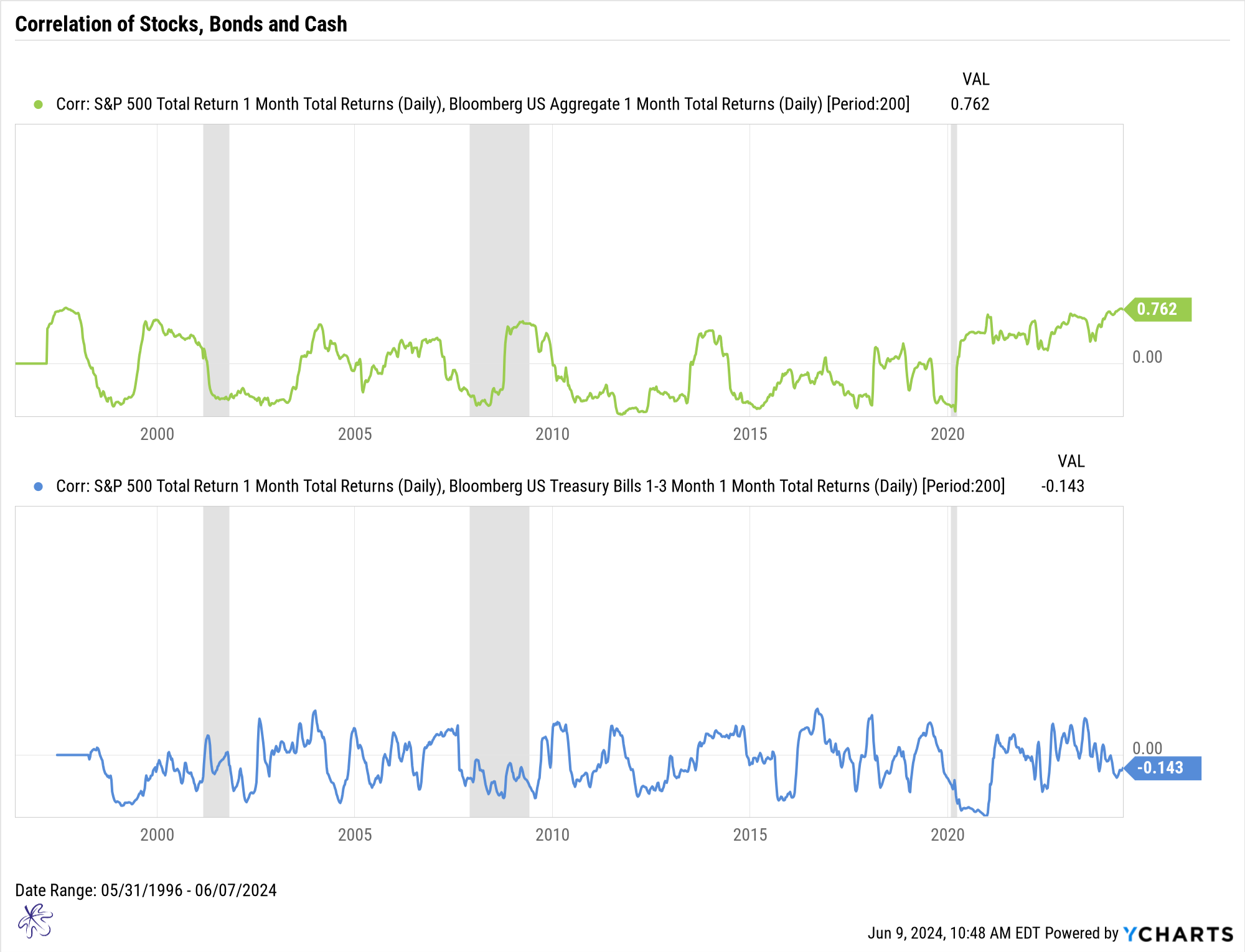

Correlations are not static. They are always changing. Prior to the pandemic recession of 2020, the correlation between stocks and bonds (green line) was close to zero or even inverse to equities. Since 2020, the correlation between stocks and bonds has been more strongly positive. Today, this correlation sits at the highest level since the late 90’s. In a nutshell, this means that stocks and investment grade domestic bonds are moving in relationship to each other and offer almost no diversification benefits.

Remember, in a properly diversified portfolio, we are utilizing assets that have correlations as close to 0 as positive. This means that each component of our asset allocation is moving independently of the other component.

Many investors consider the traditional moderate portfolio allocation to be 60% equities and 40% fixed income. In my experience, there is a heavy preference towards both domestic equities and domestic fixed income in these model portfolios. Based these correlation charts, this portfolio is providing very little diversification benefits. As a result, the portfolio may have more inherent risk than many investors realize.

I have been reading a lot of articles lately that put cash down as a tool for investors. Always arguing that they need stay invested. You may have heard, “Its time in the market…” Well, cash may be a better tool than many give it credit for. Unlike bonds, short term T-Bills and Cash equivalents are providing yields in excess of 5% and displaying a correlation of -0.14 with the S&P500 Index. So, unlike bonds, cash can be an important diversification tool at the moment.

It is important to note that correlations move in cycles. And periods to high correlations between stocks and bonds have traditionally been followed by sharp reversals of the correlations. This was the case prior to the dot com bubble burst in 2000, the Great Financial Crisis in 2008, the market volatility of 2015 and the pandemic recession of 2020.

When these correlations reversed, as it did in each of these scenarios, it was because the equity markets sold off while fixed income served as a diversifier.

The varying nature of correlations highlights the importance of having a dynamic asset allocation strategy. When market environments shift and correlations change, your asset allocation needs to adjust as well. Far too often, we see individuals with the same static portfolio year in and year out.

Ask yourself, does my asset allocation look the same as it did 6 months ago, 1 year ago, or even 3 years ago? When was the last time my portfolio was rebalanced? Does my portfolio have any cash equivalent tools in it?

If you do not have the answer to these questions, reach out to your advisor to get the answers.