What in heaven’s name does “Bear Market” even mean these days?

Most investors define a bear market by a percentage drop. That’s a mistake. Bear markets are defined by behavior, not just drawdowns, and those who overlook this in a market like today’s are bound to be bitterly punished.

And while we are in the process of tossing text book definitions to the side, it’s also time to take another look at how we are defining the term “bull market” these days.

Let’s start there.

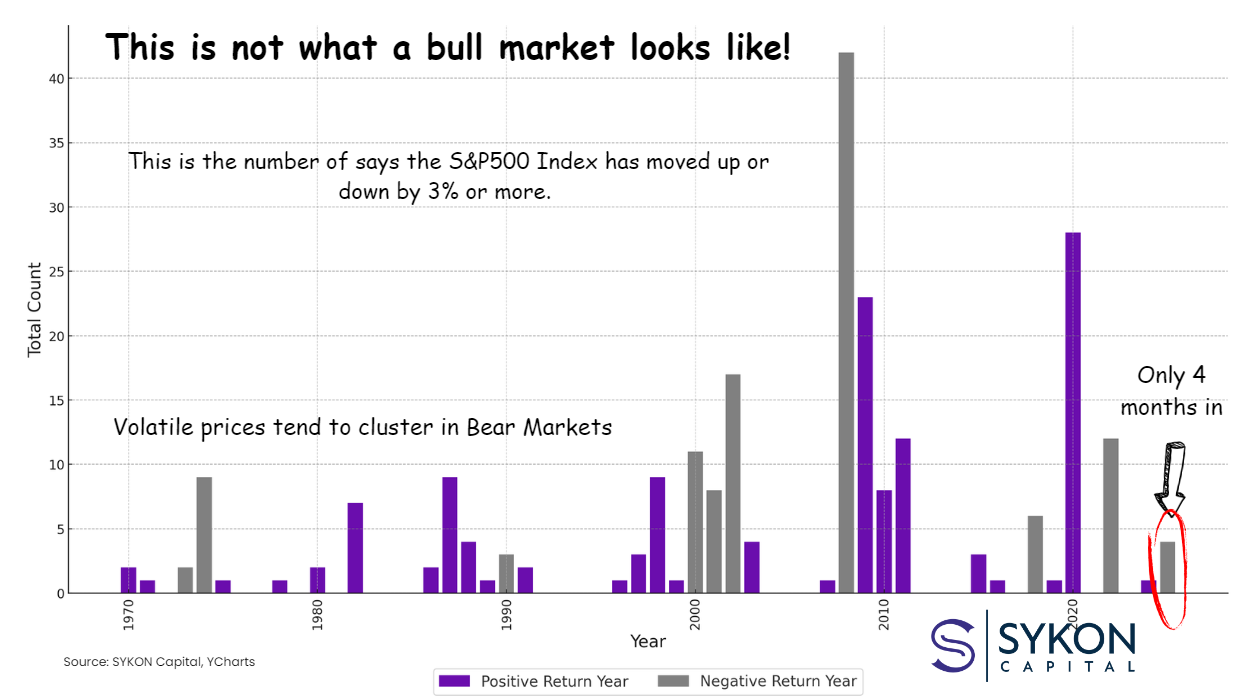

This Is Not What a Bull Market Looks Like

If you think we’re in a bull market, your definition of one might be broken.

In real bull markets, the waters are usually calm. Prices move higher steadily. Volatility stays low.

But what we’re seeing today is anything but calm—and it carries a critical message we believe investors can’t afford to ignore.

From 2012 through 2017, the S&P 500 experienced just four days where it moved more than 3%.

In contrast, in just the first four months of 2025, we’ve already seen four 3%+ moves.

This isn't normal bull market behavior.

This is volatility flashing a warning sign, and history tells us that ignoring it is a costly mistake.

What Really Defines a Bear Market? (Hint: It’s Not Just a 20% Drop)

Forget the outdated textbook definition that says a bear market is simply a 20% decline.

A real bear market is defined by behavior, not just by price.

When you study how the market moves year after year, a pattern emerges:

• Grey bars represent negative return years for the S&P 500.

• Purple bars represent positive return years.

And the grey bars dominate in volatile periods.

Volatility Is a Feature, Not a Bug, in Bear Markets

When the market trends negatively, volatility surges. In down years, we typically experience an average of 12 days where the S&P 500 moves more than 3% in a single day.

Two major exceptions, 2009 and 2020, stand out, but for very specific reasons:

• In early 2009, the financial system teetered on the brink of collapse, sending the S&P 500 to decade lows by March 2009. It took aggressive intervention from the Federal Reserve to reverse course.

• In 2020, the COVID-19 pandemic triggered the fastest market collapse in history. Again, it was extraordinary monetary and fiscal stimulus that propped up markets, actions that arguably set the stage for today’s inflation battles.

Bottom line:

• Volatility historically surges in bear markets.

• Intervention, not natural recovery, has been necessary to stop the bleeding.

• Hoping for stability without adjusting your strategy is not a plan.

Why Staying Comfortable Right Now May Be Dangerous

It’s human nature to crave stability. But when the data is flashing “caution,” staying passive may itself a risky decision.

Are you treating this market like it's calm water when it's really stormy seas?

If you’re hoping volatility will simply subside on its own, history suggests you could be setting yourself up for deeper losses.

Key takeaway:

• Volatility is telling a story.

• It’s telling us risk is still elevated.

• It’s telling us that passive strategies alone may not be enough.

How We're Managing Risk at SYKON Capital

At SYKON Capital, we aren't just waiting for conditions to improve.

We’re proactively adjusting.

Here’s how we’re helping clients navigate the storm:

• Integrating innovative ETFs designed to help manage volatility and downside risk

• Tactical asset allocation that adapts to changing environments

• Behavioral portfolio management by building portfolios that align with how real people react to risk

We believe risk should be managed intentionally, not ignored or wished away

Ready to Stress-Test Your Strategy?

Hope is not a risk management plan.

If your portfolio isn’t built to handle heightened volatility, now may be the time to make adjustments.

We’ll walk you through a tactical approach to managing risk and identifying opportunities, even in uncertain markets.

Let’s build a strategy that adapts to what’s happening, not what we wish would happen.

To set up a time to speak, reach out to julie@sykoncap.com