When Reddit Gets the Answer Right but the Outcome Wrong

Recently, I came across a Reddit post that perfectly captures a growing problem in personal finance.

Someone asked how they should gift money to their nieces and nephews after their father passed away. They didn’t fully trust the surviving parent and wanted to “do the right thing.”

The responses were exactly what you’d expect:

- Custodial accounts

- Trusts

- 529 plans

Practically, they’re incomplete.

And that distinction matters far more than most people realize.

After more than 20 years of working with families, I’ve learned something that doesn’t show up in textbooks or Reddit threads:

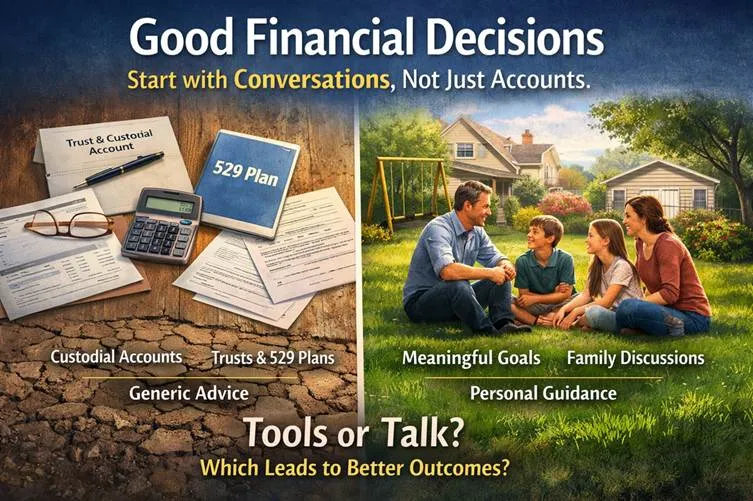

Good financial decisions don’t start with products. They start with conversations.

The Problem with Starting at the Tool Level

Reddit, blogs, and forums are great places to learn what exists.They’re terrible places to decide what fits your life.

When someone jumps straight to: “Set up a custodial account,” “Put it in a trust,” and “Use a 529.” They’re skipping the most important step entirely.

They’re guessing...

Guessing what the kids will need.

Guessing how responsible they’ll be.

Guessing how the parent will behave.

Guessing what the person who passed away would have wanted.

Once you act on those guesses, many of these decisions are irreversible.

You can’t undo a custodial account once control transfers.

You can’t easily unwind a poorly structured trust.

You can’t reclaim the time, legal fees, or emotional energy spent fixing avoidable mistakes.

This isn’t theoretical. I see it play out in real families every day.

What Experience Teaches That Reddit Can’t

Here’s what almost never shows up in online advice.1. The conversation is the strategy

If the kids are 10 and 12, or even older, the first move is not paperwork.

It’s sitting down and saying something like:

“I’m managing money that was left because your dad mattered deeply to me.

This money wasn’t meant to just sit somewhere. It was meant to help you live, grow, and do meaningful things. Let’s talk about what that looks like.”

That conversation might happen:

- With the kids and the surviving parent

- Just with the parent if the kids are younger

- Over time, in stages, as maturity grows

2. Control and communication are not opposites

A common fear I hear is: “If I talk to them, I’ll lose control.”

In reality, clear communication usually creates more control, not less.

It allows you to:

- Retain decision-making authority

- Align money with purpose

- Adjust as life changes

- Reduce resentment and confusion later

3. Custom solutions live beyond the textbook

One thing I noticed in that Reddit thread was what wasn’t discussed.

There was no mention of:

- Achievement or milestone-based structures

- Stewardship before formal legal transfers

- Incentive-style approaches that reward growth and responsibility

- Flexible frameworks that evolve as kids mature

And judgment only works when it’s grounded in a clear understanding of values, not generic best practices.

This Isn’t Just About This Family

This dynamic shows up everywhere.Parents helping adult children.

Grandparents supporting grandchildren.

Families wanting to give while alive, not just at death.

People trying to honor someone’s legacy thoughtfully.

One of the most common refrains I hear is:

“I’ll just leave them money and let them figure it out.”

Money doesn’t replace guidance.

And silence doesn’t preserve harmony.

Why People Actually Hire Financial Advisors

People don’t delegate to financial advisors because they’re incapable.They delegate because they don’t want to make important decisions in a vacuum.

They want:

- Confidence instead of guesswork

- Context instead of isolated advice

- Judgment instead of checklists

- Someone who understands what matters to them, even if they challenge how they think about it

But there is a right lens.

Hiring a financial advisor isn’t about finding someone who thinks exactly like you.

It’s about finding someone who understands your values well enough to apply professional judgment, and push back when needed.

A More Familiar Parallel: The Lawn

I could take care of my own lawn and garden. And I used to.I’d spend hours researching fertilizers, weeds, soil treatments, grass types. I’d run to the store, talk to the associate, haul everything home, spread it myself, overdo it, burn the lawn, then spend even more time figuring out how to fix the mistake.

Weekends disappeared. My back hurt. My knees hurt. And somehow, the lawn still didn’t look that great.

Or I could pay my landscaper.

They handle everything. The lawn looks better. The gardens thrive. And instead of spending 20 hours over a weekend spreading mulch and fixing self-inflicted mistakes, I spend that time with my kids, playing golf, playing hockey, and doing the things I actually value.

Yes, it costs money.

But when I look at the time saved, the frustration avoided, the physical wear and tear reduced, and the outcome I get, the math isn’t even close.

And importantly, I didn’t hire them because I don’t understand lawns.

I hired them because I understand my priorities.

Why That Parallel Matters

That’s how most people arrive at working with a financial advisor.Not because they’re incapable.

Not because they want to abdicate responsibility.

But because:

- They don’t want to spend their limited time researching edge cases

- They don’t want to learn by making irreversible mistakes

- They want decisions filtered through what they value most

They require clarity around what matters and trust in someone who can apply a professional lens, challenge assumptions, and help avoid costly missteps.

That’s the difference between advice and guidance.

The Real Takeaway

Generic advice isn’t dangerous because it’s wrong.It’s dangerous because it ignores context.

The real value comes from:

- Conversations before constructions

- Intent before implementation

- Values before structures

Start with a conversation.

Then build the strategy around real life, not a comment thread.

A Final Thought

If you’ve found yourself reading forums, articles, and opinions trying to “get it right,” you’re not doing anything wrong. That usually means you care about the outcome.The real question is whether you want advice that fits a textbook, or guidance that fits your values.

That’s where clarity tends to show up.

Advisory Services offered through SYKON Capital LLC, a registered investment advisor with the U.S. Securities and Exchange Commission. This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. The information contained in this presentation has been compiled from third party sources and is believed to be reliable as of the date of this report. Past performance is not indicative of future returns and diversification neither assures a profit nor guarantees against loss in a declining market. Investments involve risk and are not guaranteed.