Why Ignoring Sector Momentum Could Cost You: How to Protect and Grow Your Portfolio

In today's fast-moving markets, it’s easy to think you can simply "set it and forget it" with a passive investment strategy. But sector momentum, how various sectors rise or fall in strength, can have a significant impact on your portfolio's performance. Ignoring these shifts could mean missing key opportunities or, worse, holding onto sectors that are quietly underperforming, dragging down your returns.

Navigating market volatility requires precision, and at SYKON Capital, we've developed unique, custom-designed indicators to help you identify both potential risks and opportunities across various sectors. Starting this week, on Thursdays, I’ll be sharing the weekly output of our proprietary momentum and trend indicators for the S&P 500 sectors and select asset classes.

Why Does Sector Momentum Matter?

Sectors like Information Technology, for instance, have seen explosive growth in the past, but when momentum shifts, those who remain invested without checking these signals may see prolonged downturns. On the other hand, sectors like Utilities or Consumer Staples might experience a surge, offering upside potential. If you’re unaware of these shifts, you could be losing out on the chance to realign your portfolio.

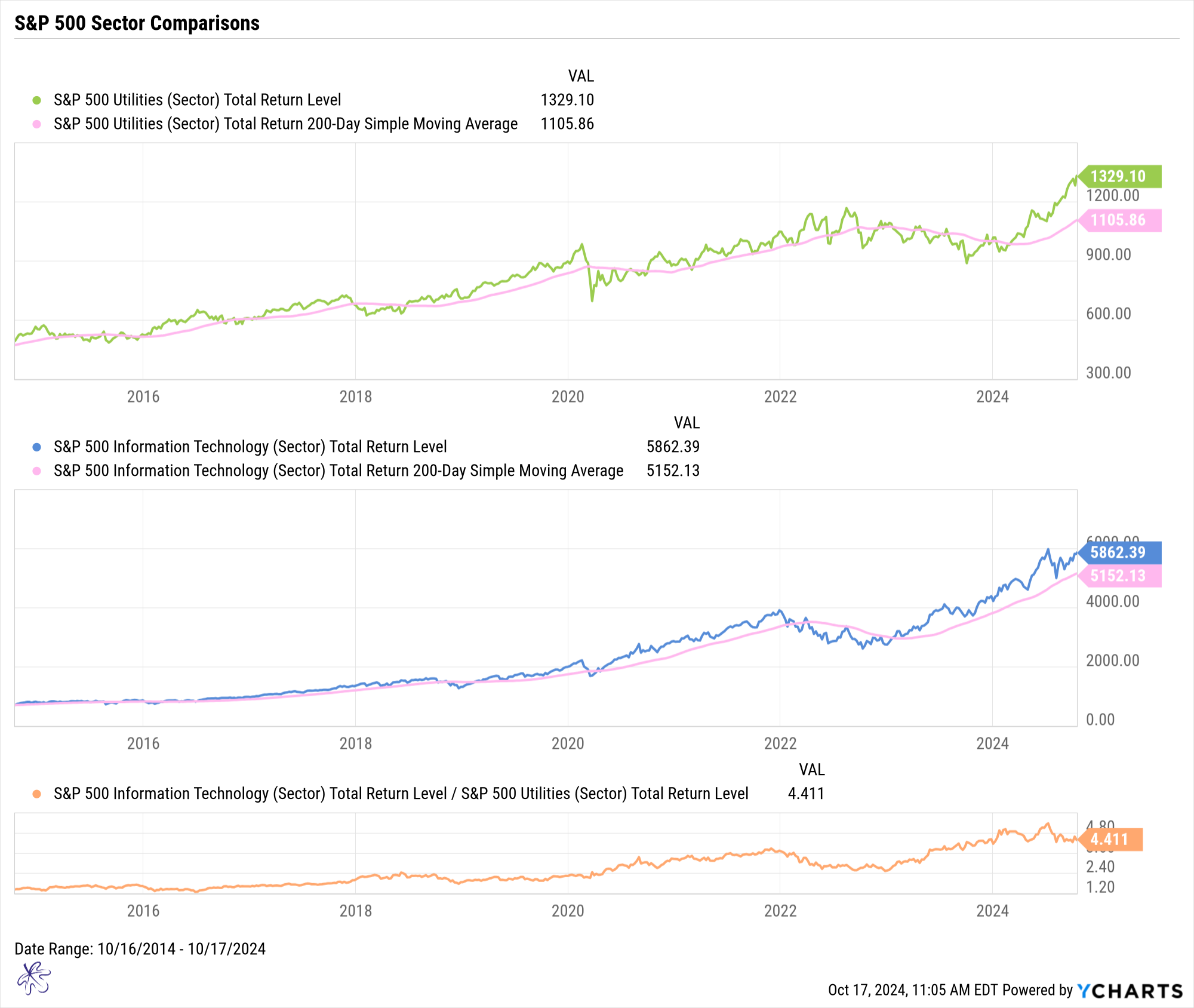

Sector momentum helps us identify where capital is flowing. This matters because it directly impacts risk and reward. A simple example of this is when sectors such as the S&P 500 utilities sector or the S&P500 Information Technology sector cross below their 200-day simple moving average. This shift in momentum and trend can often signal that more downside is ahead.

For example, during the Market sell off in 2022, the State Street Spiders information technology sector ETF (XLK) declined by 33.60% during a period of negative trend and momentum. Utilizing technical tools to identify trend and momentum shifts can potentially help mitigate draw downs during these periods.

Below are the current signals from our proprietary momentum and trend indicators. A positive signal means both momentum and trend are favorable, while a negative signal indicates the opposite. Here’s where the data stands for this week:

S&P 500 Index Sectors:

- Information Technology = Negative

- Financials = Positive

- Healthcare = Positive

- Consumer Discretionary = Positive

- Consumer Staples = Positive

- Industrials = Positive

- Energy = Negative

- Utilities = Positive

- Materials = Positive

- Communications = Positive

- Real Estate = Positive

Key Asset Classes:

- Bitcoin = Negative

- Long-Term Treasuries = Positive

- High Yield Bonds = Positive

- Oil = Negative

- Gold = Positive

- Small-Cap Stocks = Positive

- US Dollar = Negative

What’s the Risk of Ignoring Sector Movements?

If you choose to ignore these trends, your portfolio could become overweight in sectors that are losing momentum, increasing the risk of capital erosion. Meanwhile, you miss opportunities to capture gains in rising sectors. Over time, this can create a significant gap between the performance of active, momentum-aware portfolios and passive ones.

In this weekly publication, I will share our proprietary momentum and trend signals for the S&P 500 sectors and key asset classes to help you stay ahead of these shifts and make data-driven decisions for your investments.