Has the FOMC Pulled Off the Soft Landing?

The markets may need to pause and take a deep breadth before they have the potential to move higher. At the end of December, we posted about the extreme overbought conditions indicated by the RSI of the Dow Jones Industrial Average, see Article here. These types of extreme conditions can be positive in the long term, but in the short term are often associated with pull backs and an increase in market volatility.

The S&P500 index has recently sold off its highs, coming back into the support at 4685. This weakness was preceded by a bearish RSI divergence. This is when the index makes a new high, but the RSI makes a lower high.

Much of this rally was driven by the drop in interest rates. The 10-year treasury yield declined from a high of 4.99% on October 19 to a low of 3.78% on December 27. This decline in yields and the subsequent equity rally was induced by market speculation that the FOMC is done hiking rates and is in fact potentially going to be cutting rates as early as this year.

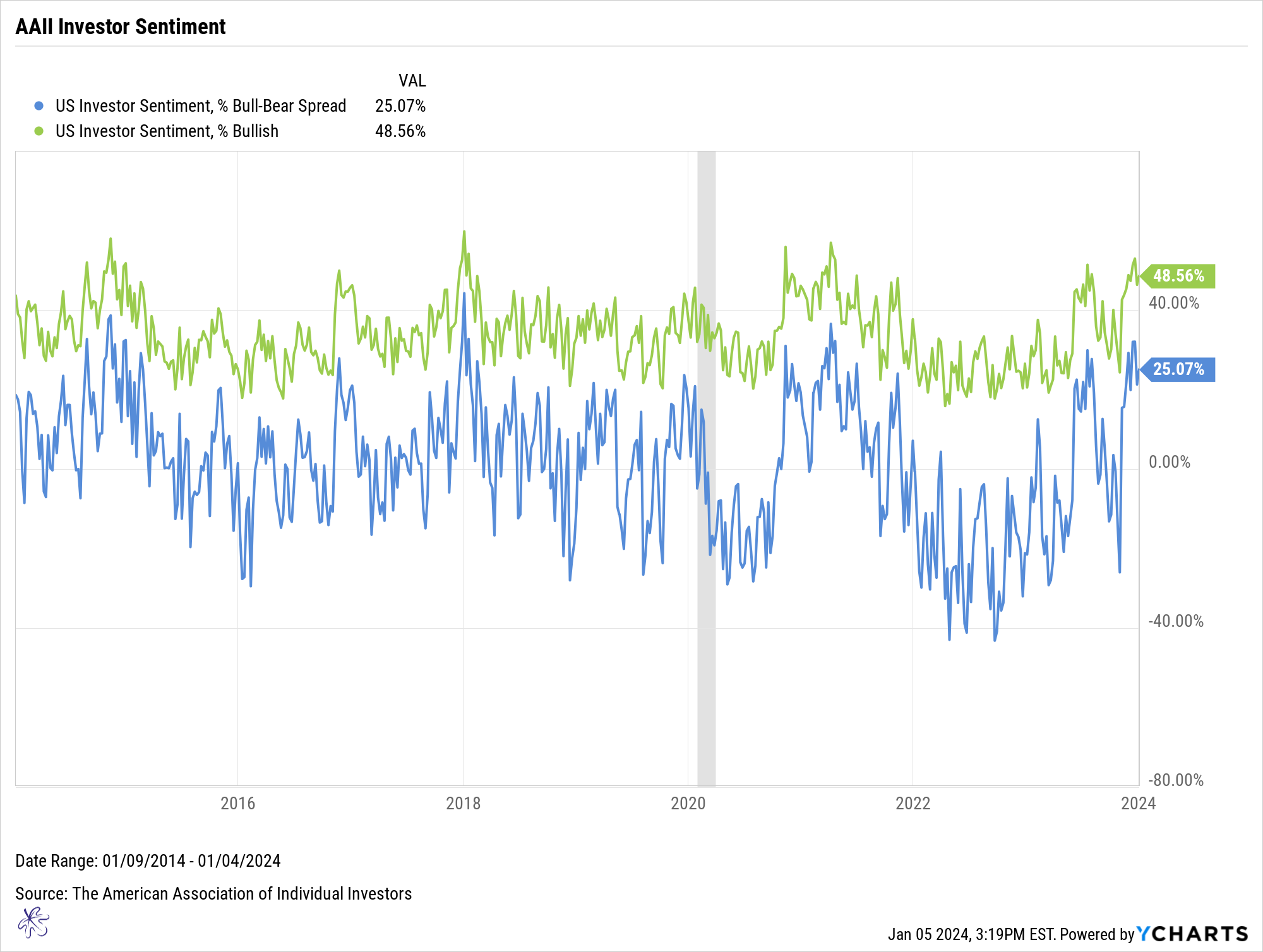

This has led to extreme optimism by investors. The AAII investor sentiment survey reached extreme optimism levels in December. The percentage of bullish respondents reached over 50% briefly and the spread between the bulls and bears exceeded 30%. This can be considered euphoric by most standards.

There are two great quotes that some to mind:

"Bull markets are born on pessimism, grown on skepticism, mature on optimism and die on euphoria. The time of maximum pessimism is the best time to buy and the time of maximum optimism if the best time to sell."

- John Templeton

"Be Fearful when others are greedy and be greedy when others are fearful."

- Warren Buffet

I am not intending for these quotes to be advice, but they should serve as a framework for how two of the greatest investors of all time view the markets. As such, the AAII investors sentiment survey often serves as a contrarian indicator.

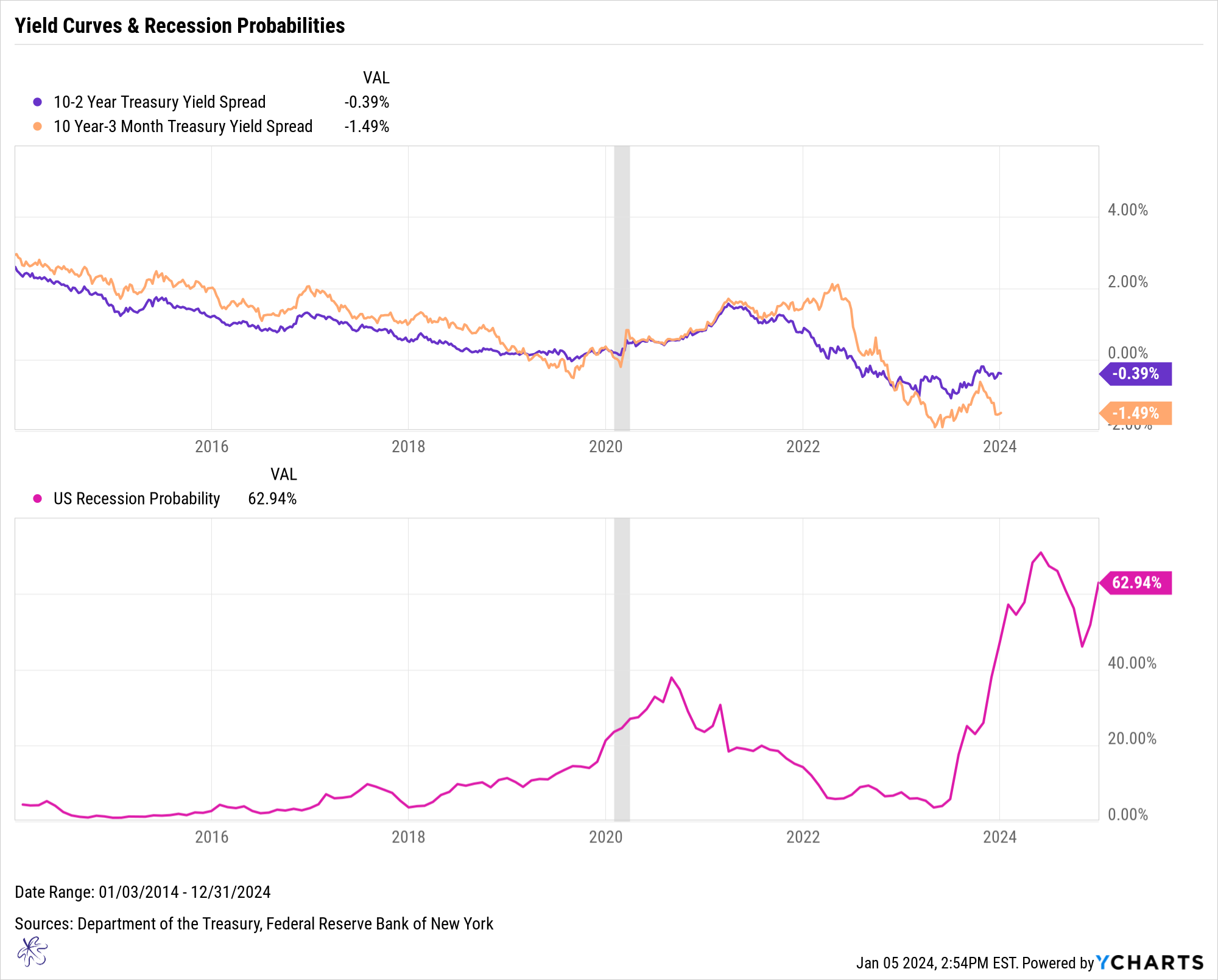

Lower treasury yields because of the renewed rate cut expectation fueled the rally. The unintended consequences of the longer dated yields dropping, while short term yields remained steady, is the yield curves have started to invert once again. This is causing forward-looking recession probabilities to spike back up. The current probabilities peak at over 70% in April of 2024 and then spike higher to 62.94% in December of 2024.

We have spoken about it many times before, to declare victory over inflation and confirm a soft landing, the yield curves would need to normalize on a sustainable basis without a recession occurring. Something that has yet to happen.

It’s not just the yield curve that gives us a cause for pause. According to Dow Theory, one of the oldest technical indicators in existence, the Dow Jones Industrial Average (DJIA) highs should be confirmed with a new high in the Dow Jones Transportation Average (DJTA) as well.

The new all-time high in the DJIA (Blue Line) was not confirmed with a new high in the DJTA (Orange Line). Instead, the transportation average made a lower high, which is often considered a bearish divergence according to Dow Theory. A similar divergence took place around January of 2022.

The purpose of this post is not to instill fear. It is simply intended as a word of caution. There are still a lot of headwinds. Granted, we can say this about any market, but over the past couple of years we have been rewarded for focusing on the data. It kept us out of the recession crowd in 2022. This was a market riddled with low recession probabilities and extreme oversold conditions. Quite the opposite of what we are experiencing today.

The most dangerous moments in the markets are the ones where investors have become complacent. That is where we are today.

Make sure you check in on your portfolio. Have you recently rebalanced it? The big run up recently may have caused your asset allocation to shift. This could introduce unintended risk.

Have you stress tested your existing allocation? Do you understand the full downside potential of your holdings and asset allocation in different scenarios, such as a recession or reemergence of inflation?

Given risk-free rates are over 5% today, the hurdle for forward looking returns in risk assets is very high, especially as the risk is currently elevated at these lofty market levels.

Stay vigilant, be patient and at least consider the advice of two of the greatest investors of all time. Is this a market they would be putting money to work in?